- Malaysia

- /

- Semiconductors

- /

- KLSE:JFTECH

With EPS Growth And More, JF Technology Berhad (KLSE:JFTECH) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like JF Technology Berhad (KLSE:JFTECH). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for JF Technology Berhad

JF Technology Berhad's Improving Profits

In the last three years JF Technology Berhad's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, JF Technology Berhad's EPS soared from RM0.014 to RM0.019, over the last year. That's a commendable gain of 41%.

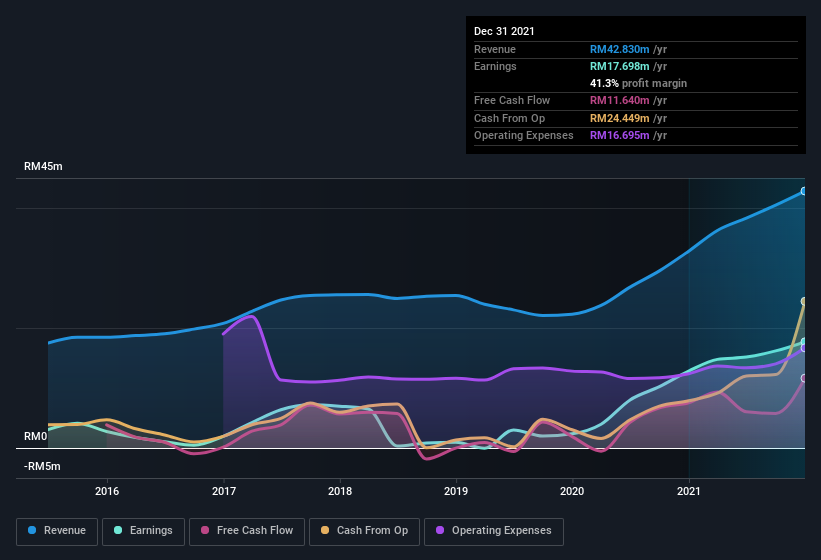

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. JF Technology Berhad maintained stable EBIT margins over the last year, all while growing revenue 31% to RM43m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

JF Technology Berhad isn't a huge company, given its market capitalization of RM802m. That makes it extra important to check on its balance sheet strength.

Are JF Technology Berhad Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that JF Technology Berhad insiders own a significant number of shares certainly appeals to me. In fact, they own 44% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about RM353m riding on the stock, at current prices. That's nothing to sneeze at!

Does JF Technology Berhad Deserve A Spot On Your Watchlist?

You can't deny that JF Technology Berhad has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. We should say that we've discovered 1 warning sign for JF Technology Berhad that you should be aware of before investing here.

Although JF Technology Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:JFTECH

JF Technology Berhad

An investment holding company, manufactures and trades in electronic products, components, test probes, and probe cards in Malaysia, China, Singapore, the United States, the Philippines, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives