- Malaysia

- /

- Semiconductors

- /

- KLSE:GENETEC

Genetec Technology Berhad's (KLSE:GENETEC) P/E Still Appears To Be Reasonable

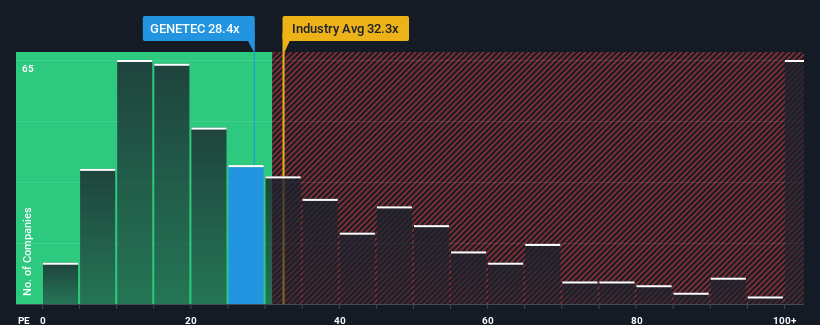

With a price-to-earnings (or "P/E") ratio of 28.4x Genetec Technology Berhad (KLSE:GENETEC) may be sending very bearish signals at the moment, given that almost half of all companies in Malaysia have P/E ratios under 15x and even P/E's lower than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings that are retreating more than the market's of late, Genetec Technology Berhad has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Genetec Technology Berhad

Is There Enough Growth For Genetec Technology Berhad?

The only time you'd be truly comfortable seeing a P/E as steep as Genetec Technology Berhad's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. Still, the latest three year period has seen an excellent 3,482% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 31% per year over the next three years. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Genetec Technology Berhad's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Genetec Technology Berhad maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Genetec Technology Berhad is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:GENETEC

Genetec Technology Berhad

An investment holding company, designs, manufactures, and sells smart automation systems, customized factory automated equipment, and integrated systems in the United States, Europe, the Middle East, Malaysia, Thailand, Mexico, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026