- Malaysia

- /

- Semiconductors

- /

- KLSE:FPGROUP

FoundPac Group Berhad (KLSE:FPGROUP) Stock Rockets 31% As Investors Are Less Pessimistic Than Expected

The FoundPac Group Berhad (KLSE:FPGROUP) share price has done very well over the last month, posting an excellent gain of 31%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.5% over the last year.

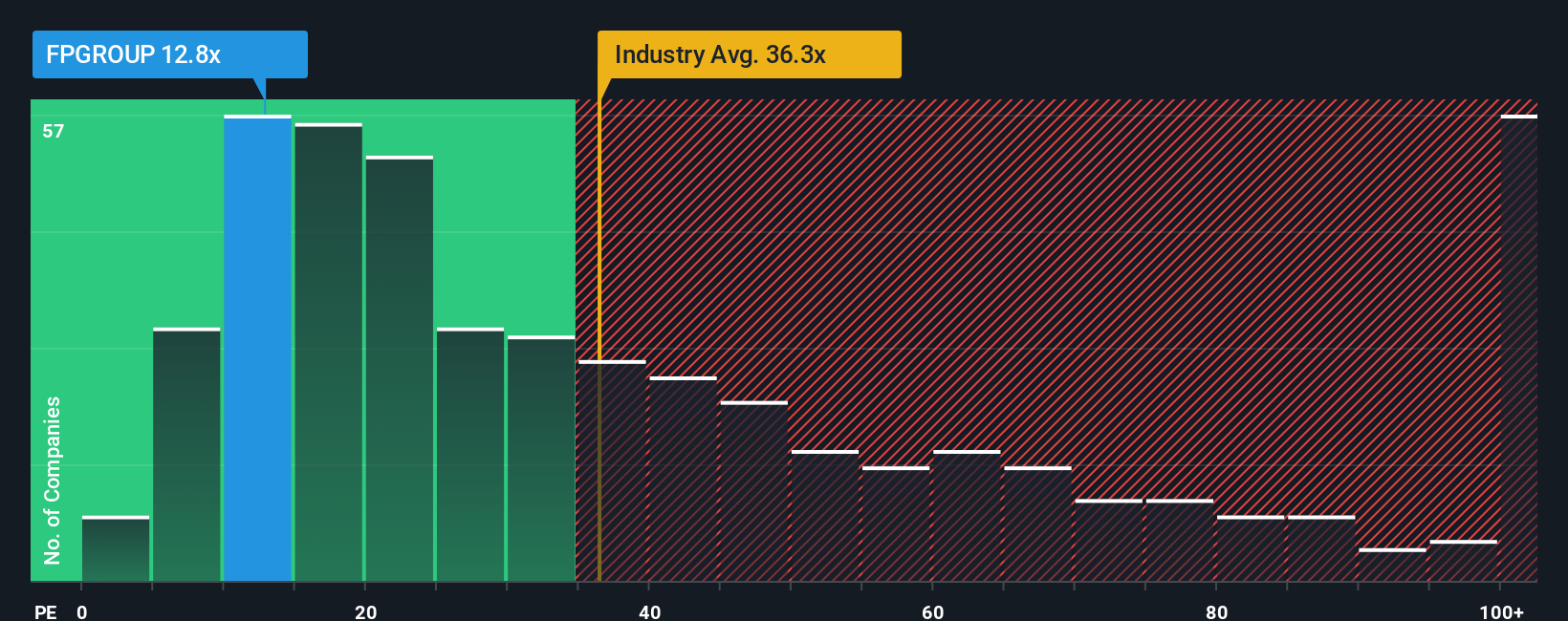

Although its price has surged higher, there still wouldn't be many who think FoundPac Group Berhad's price-to-earnings (or "P/E") ratio of 12.8x is worth a mention when the median P/E in Malaysia is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been quite advantageous for FoundPac Group Berhad as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for FoundPac Group Berhad

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like FoundPac Group Berhad's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 108%. The latest three year period has also seen a 7.9% overall rise in EPS, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 17% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that FoundPac Group Berhad is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On FoundPac Group Berhad's P/E

FoundPac Group Berhad appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of FoundPac Group Berhad revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware FoundPac Group Berhad is showing 4 warning signs in our investment analysis, and 1 of those is concerning.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FPGROUP

FoundPac Group Berhad

An investment holding company, designs, develops, manufactures, markets, and sells semiconductor products in Malaysia, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives