- Malaysia

- /

- Semiconductors

- /

- KLSE:AEMULUS

Is Aemulus Holdings Berhad (KLSE:AEMULUS) Weighed On By Its Debt Load?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Aemulus Holdings Berhad (KLSE:AEMULUS) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Aemulus Holdings Berhad

What Is Aemulus Holdings Berhad's Net Debt?

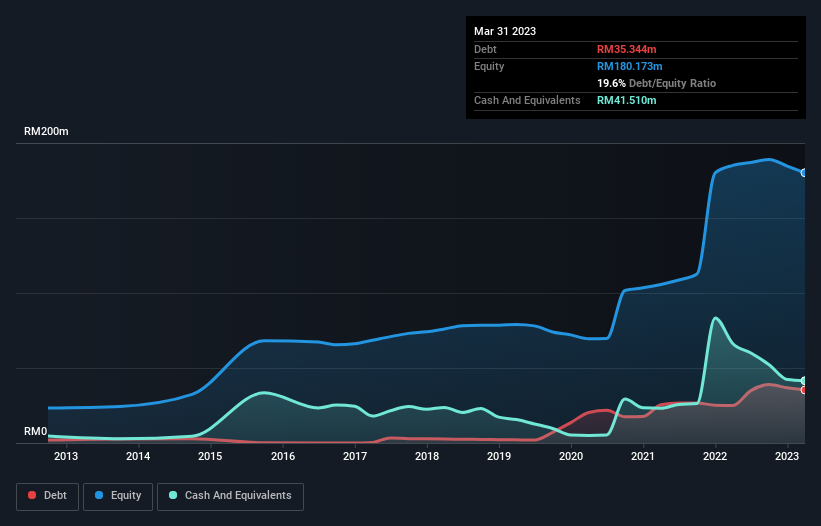

The image below, which you can click on for greater detail, shows that at March 2023 Aemulus Holdings Berhad had debt of RM35.3m, up from RM25.0m in one year. But it also has RM41.5m in cash to offset that, meaning it has RM6.17m net cash.

How Healthy Is Aemulus Holdings Berhad's Balance Sheet?

The latest balance sheet data shows that Aemulus Holdings Berhad had liabilities of RM29.4m due within a year, and liabilities of RM16.0m falling due after that. On the other hand, it had cash of RM41.5m and RM61.1m worth of receivables due within a year. So it actually has RM57.3m more liquid assets than total liabilities.

This excess liquidity suggests that Aemulus Holdings Berhad is taking a careful approach to debt. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Simply put, the fact that Aemulus Holdings Berhad has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Aemulus Holdings Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Aemulus Holdings Berhad made a loss at the EBIT level, and saw its revenue drop to RM50m, which is a fall of 29%. That makes us nervous, to say the least.

So How Risky Is Aemulus Holdings Berhad?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Aemulus Holdings Berhad lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through RM29m of cash and made a loss of RM6.1m. With only RM6.17m on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Aemulus Holdings Berhad that you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AEMULUS

Aemulus Holdings Berhad

An investment holding company, designs and develops automated test equipment, and test and measurement instruments in Malaysia, China, Singapore, Vietnam, Korea, the United States, Taiwan, and internationally.

Low risk with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion