- Malaysia

- /

- Retail Distributors

- /

- KLSE:SOLID

Here's Why Solid Automotive Berhad (KLSE:SOLID) Has A Meaningful Debt Burden

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Solid Automotive Berhad (KLSE:SOLID) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Solid Automotive Berhad

How Much Debt Does Solid Automotive Berhad Carry?

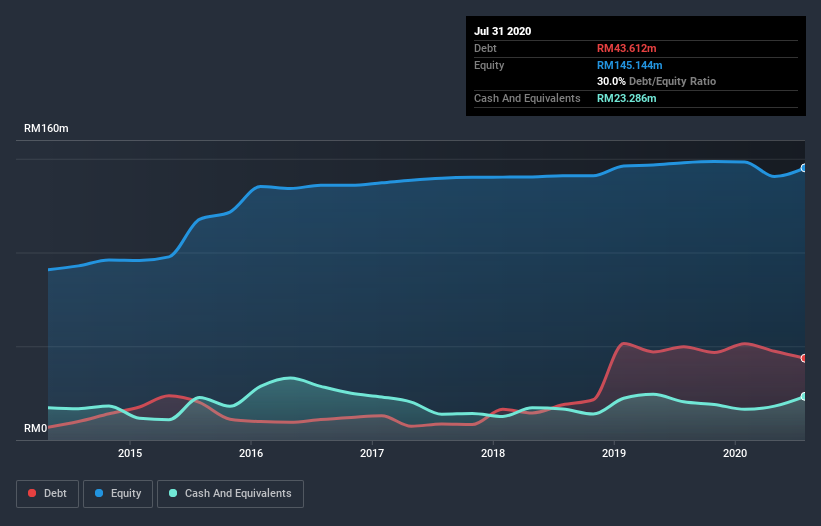

You can click the graphic below for the historical numbers, but it shows that Solid Automotive Berhad had RM43.6m of debt in July 2020, down from RM49.7m, one year before. However, because it has a cash reserve of RM23.3m, its net debt is less, at about RM20.3m.

How Strong Is Solid Automotive Berhad's Balance Sheet?

According to the last reported balance sheet, Solid Automotive Berhad had liabilities of RM77.9m due within 12 months, and liabilities of RM18.8m due beyond 12 months. On the other hand, it had cash of RM23.3m and RM69.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM4.38m.

Of course, Solid Automotive Berhad has a market capitalization of RM85.2m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Solid Automotive Berhad's net debt to EBITDA ratio of 4.2, we think its super-low interest cover of 0.56 times is a sign of high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Worse, Solid Automotive Berhad's EBIT was down 74% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Solid Automotive Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Solid Automotive Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Solid Automotive Berhad's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least it's pretty decent at staying on top of its total liabilities; that's encouraging. We're quite clear that we consider Solid Automotive Berhad to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Solid Automotive Berhad (including 1 which is makes us a bit uncomfortable) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Solid Automotive Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:SOLID

Solid Automotive Berhad

An investment holding company, engages in the trading and distribution of automotive spare parts and components in Malaysia, the Middle East, Africa, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives