- Malaysia

- /

- Real Estate

- /

- KLSE:TALAMT

Health Check: How Prudently Does Talam Transform Berhad (KLSE:TALAMT) Use Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Talam Transform Berhad (KLSE:TALAMT) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Talam Transform Berhad

What Is Talam Transform Berhad's Debt?

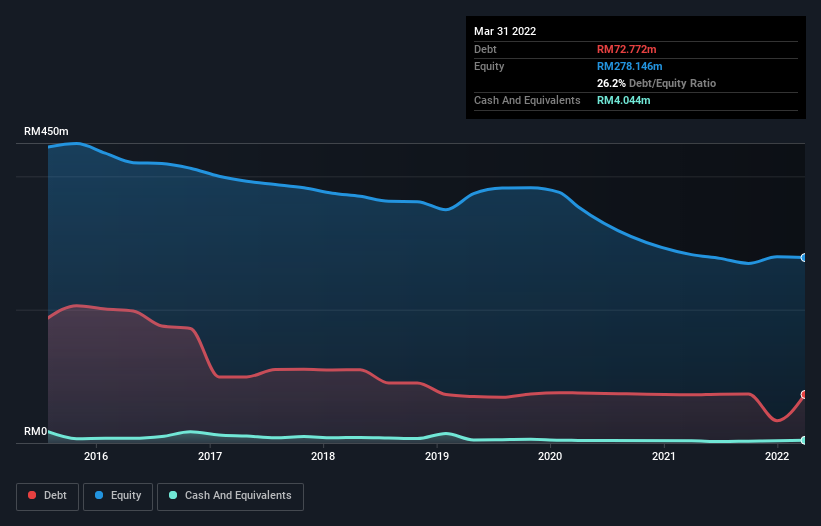

The chart below, which you can click on for greater detail, shows that Talam Transform Berhad had RM72.8m in debt in March 2022; about the same as the year before. However, it also had RM4.04m in cash, and so its net debt is RM68.7m.

How Healthy Is Talam Transform Berhad's Balance Sheet?

The latest balance sheet data shows that Talam Transform Berhad had liabilities of RM418.7m due within a year, and liabilities of RM4.86m falling due after that. On the other hand, it had cash of RM4.04m and RM83.9m worth of receivables due within a year. So it has liabilities totalling RM335.7m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the RM85.9m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Talam Transform Berhad would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Talam Transform Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Talam Transform Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 75%, to RM67m. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

While we can certainly appreciate Talam Transform Berhad's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Its EBIT loss was a whopping RM15m. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely, given it is low on liquid assets, and burned through RM19m in the last year. So we think this stock is risky, like walking through a dirty dog park with a mask on. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Talam Transform Berhad has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Talam Transform Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TALAMT

Talam Transform Berhad

An investment holding company, engages in the property development business in Malaysia.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026