- Malaysia

- /

- Real Estate

- /

- KLSE:SYMLIFE

What Can We Make Of Symphony Life Berhad's (KLSE:SYMLIFE) CEO Compensation?

Mohamed Bin Yahya has been the CEO of Symphony Life Berhad (KLSE:SYMLIFE) since 2005, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Symphony Life Berhad.

Check out our latest analysis for Symphony Life Berhad

How Does Total Compensation For Mohamed Bin Yahya Compare With Other Companies In The Industry?

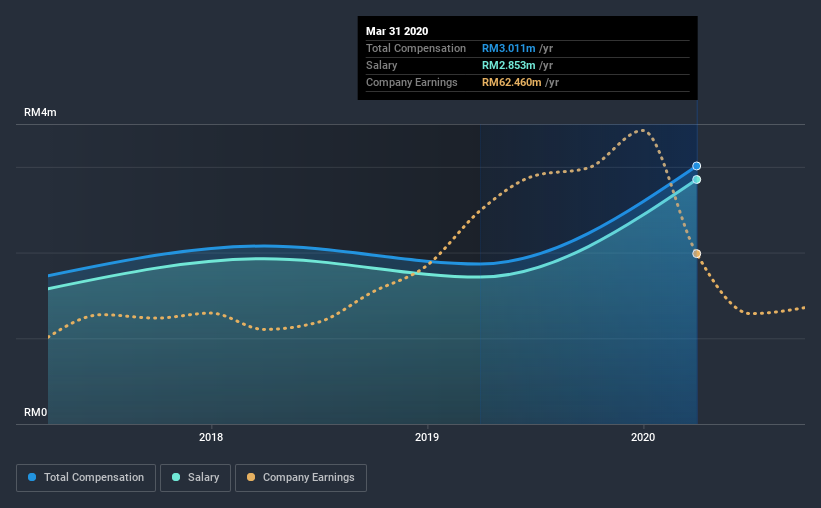

According to our data, Symphony Life Berhad has a market capitalization of RM288m, and paid its CEO total annual compensation worth RM3.0m over the year to March 2020. We note that's an increase of 61% above last year. Notably, the salary which is RM2.85m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under RM812m, the reported median total CEO compensation was RM802k. This suggests that Mohamed Bin Yahya is paid more than the median for the industry. Moreover, Mohamed Bin Yahya also holds RM67m worth of Symphony Life Berhad stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM2.9m | RM1.7m | 95% |

| Other | RM158k | RM154k | 5% |

| Total Compensation | RM3.0m | RM1.9m | 100% |

On an industry level, roughly 80% of total compensation represents salary and 20% is other remuneration. It's interesting to note that Symphony Life Berhad pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Symphony Life Berhad's Growth

Symphony Life Berhad has reduced its earnings per share by 17% a year over the last three years. Its revenue is down 24% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Symphony Life Berhad Been A Good Investment?

Since shareholders would have lost about 23% over three years, some Symphony Life Berhad investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As previously discussed, Mohamed is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. What's equally worrying is that the company isn't growing by our analysis. Understandably, the company's shareholders might have some questions about the CEO's remuneration, given the disappointing performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 6 warning signs for Symphony Life Berhad (1 is a bit concerning!) that you should be aware of before investing here.

Important note: Symphony Life Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Symphony Life Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SYMLIFE

Symphony Life Berhad

An investment holding company, engages in the development and investment of properties in Malaysia.

Adequate balance sheet with low risk.

Market Insights

Community Narratives