Stock Analysis

- Malaysia

- /

- Retail REITs

- /

- KLSE:PAVREIT

What Type Of Returns Would Pavilion Real Estate Investment Trust's(KLSE:PAVREIT) Shareholders Have Earned If They Purchased Their SharesYear Ago?

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Pavilion Real Estate Investment Trust (KLSE:PAVREIT) shareholders over the last year, as the share price declined 17%. That's disappointing when you consider the market returned 4.3%. However, the longer term returns haven't been so bad, with the stock down 9.9% in the last three years. It's down 3.3% in the last seven days.

See our latest analysis for Pavilion Real Estate Investment Trust

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

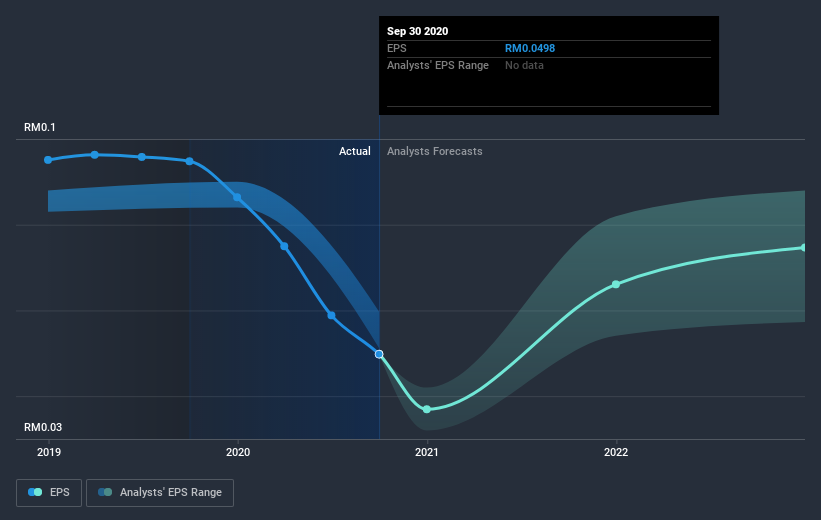

Unfortunately Pavilion Real Estate Investment Trust reported an EPS drop of 47% for the last year. This fall in the EPS is significantly worse than the 17% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Pavilion Real Estate Investment Trust's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Pavilion Real Estate Investment Trust the TSR over the last year was -14%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Pavilion Real Estate Investment Trust shareholders are down 14% for the year (even including dividends), but the market itself is up 4.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Pavilion Real Estate Investment Trust better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Pavilion Real Estate Investment Trust (of which 1 is significant!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade Pavilion Real Estate Investment Trust, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Pavilion Real Estate Investment Trust is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:PAVREIT

Pavilion Real Estate Investment Trust

Listed on 7 December 2011, with the largest exposure to the retail sector by any listed Malaysian REIT, Pavilion REIT owns a RM5.9 billion portfolio based on appraised value, to which its most prominent asset is the Pavilion Kuala Lumpur Mall that is located in Bukit Bintang, Kuala Lumpur, Malaysia.

Undervalued established dividend payer.