- Malaysia

- /

- Real Estate

- /

- KLSE:KSL

Here's Why KSL Holdings Berhad (KLSE:KSL) Can Manage Its Debt Responsibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that KSL Holdings Berhad (KLSE:KSL) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for KSL Holdings Berhad

How Much Debt Does KSL Holdings Berhad Carry?

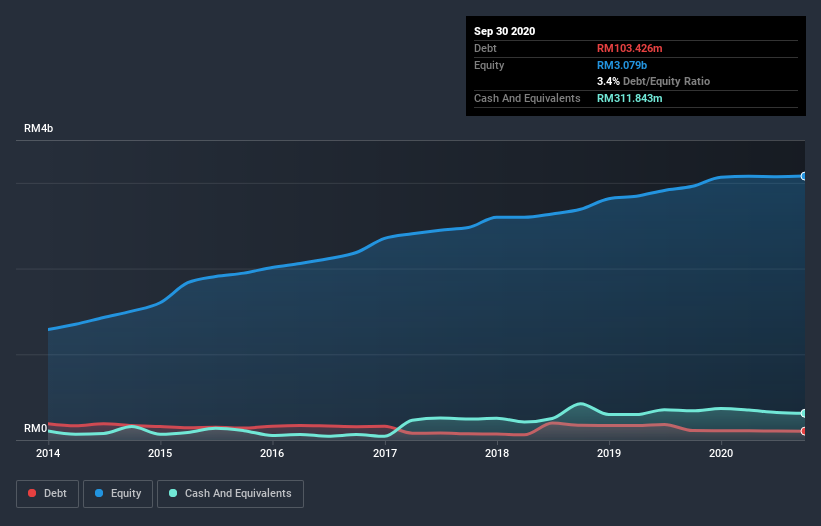

The image below, which you can click on for greater detail, shows that KSL Holdings Berhad had debt of RM103.4m at the end of September 2020, a reduction from RM110.4m over a year. However, it does have RM311.8m in cash offsetting this, leading to net cash of RM208.4m.

How Strong Is KSL Holdings Berhad's Balance Sheet?

According to the last reported balance sheet, KSL Holdings Berhad had liabilities of RM149.7m due within 12 months, and liabilities of RM193.5m due beyond 12 months. Offsetting this, it had RM311.8m in cash and RM125.4m in receivables that were due within 12 months. So it can boast RM93.9m more liquid assets than total liabilities.

It's good to see that KSL Holdings Berhad has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, KSL Holdings Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

In fact KSL Holdings Berhad's saving grace is its low debt levels, because its EBIT has tanked 63% in the last twelve months. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since KSL Holdings Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While KSL Holdings Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, KSL Holdings Berhad produced sturdy free cash flow equating to 79% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that KSL Holdings Berhad has net cash of RM208.4m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of RM49m, being 79% of its EBIT. So we are not troubled with KSL Holdings Berhad's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for KSL Holdings Berhad (of which 1 is a bit concerning!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade KSL Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KSL Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:KSL

KSL Holdings Berhad

An investment holding company, engages in the property development business in Malaysia.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success