- Malaysia

- /

- Real Estate

- /

- KLSE:IBHD

Did You Manage To Avoid I-Berhad's (KLSE:IBHD) Painful 66% Share Price Drop?

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. To wit, the I-Berhad (KLSE:IBHD) share price managed to fall 66% over five long years. That's not a lot of fun for true believers. And some of the more recent buyers are probably worried, too, with the stock falling 50% in the last year. Even worse, it's down 14% in about a month, which isn't fun at all.

View our latest analysis for I-Berhad

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

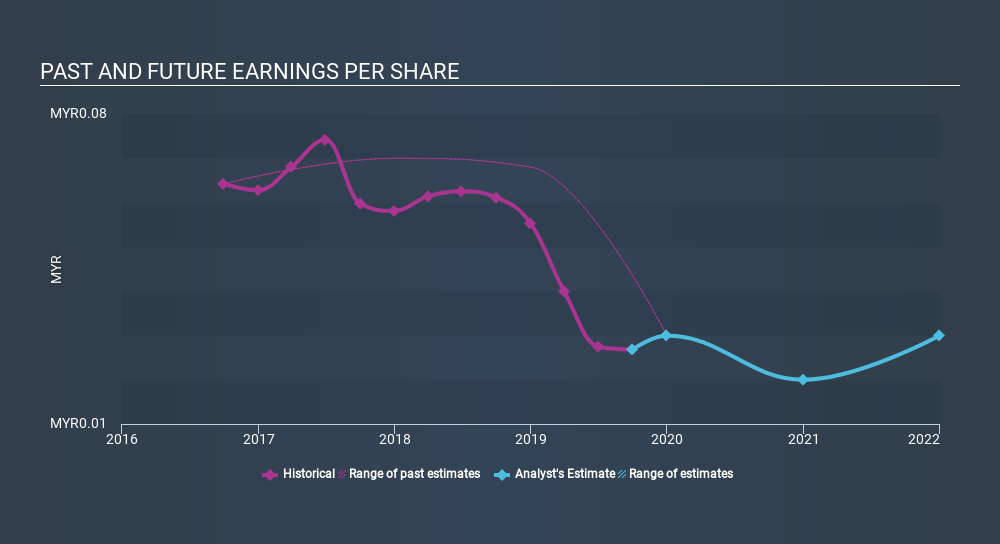

During the five years over which the share price declined, I-Berhad's earnings per share (EPS) dropped by 24% each year. This fall in the EPS is worse than the 20% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on I-Berhad's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, I-Berhad's TSR for the last 5 years was -60%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that I-Berhad shareholders are down 47% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 4.8%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 17% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for I-Berhad that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:IBHD

I-Berhad

An investment holding company, engages in the property investment and development activities in Malaysia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives