- Malaysia

- /

- Real Estate

- /

- KLSE:ECOWLD

Does Eco World Development Group Berhad (KLSE:ECOWLD) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Eco World Development Group Berhad (KLSE:ECOWLD) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Our analysis indicates that ECOWLD is potentially undervalued!

How Much Debt Does Eco World Development Group Berhad Carry?

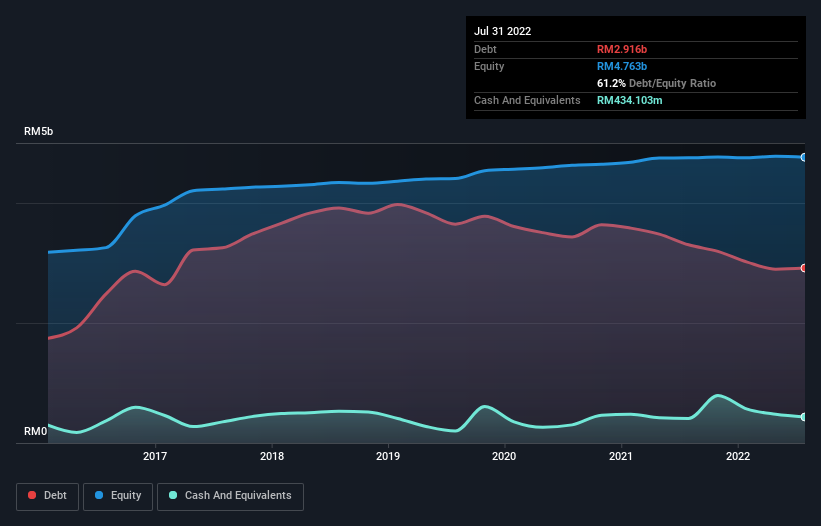

The image below, which you can click on for greater detail, shows that Eco World Development Group Berhad had debt of RM2.92b at the end of July 2022, a reduction from RM3.30b over a year. However, it also had RM434.1m in cash, and so its net debt is RM2.48b.

How Healthy Is Eco World Development Group Berhad's Balance Sheet?

We can see from the most recent balance sheet that Eco World Development Group Berhad had liabilities of RM2.87b falling due within a year, and liabilities of RM1.65b due beyond that. Offsetting these obligations, it had cash of RM434.1m as well as receivables valued at RM674.6m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM3.41b.

This deficit casts a shadow over the RM2.00b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Eco World Development Group Berhad would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a net debt to EBITDA ratio of 8.2, it's fair to say Eco World Development Group Berhad does have a significant amount of debt. However, its interest coverage of 6.4 is reasonably strong, which is a good sign. Notably, Eco World Development Group Berhad's EBIT launched higher than Elon Musk, gaining a whopping 141% on last year. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Eco World Development Group Berhad can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Eco World Development Group Berhad actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

We feel some trepidation about Eco World Development Group Berhad's difficulty level of total liabilities, but we've got positives to focus on, too. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. We think that Eco World Development Group Berhad's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Eco World Development Group Berhad that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Eco World Development Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ECOWLD

Eco World Development Group Berhad

An investment holding company, engages in the property development and investment activities in Malaysia.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026