- Malaysia

- /

- Real Estate

- /

- KLSE:YONGTAI

Health Check: How Prudently Does Yong Tai Berhad (KLSE:YONGTAI) Use Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Yong Tai Berhad (KLSE:YONGTAI) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Yong Tai Berhad

What Is Yong Tai Berhad's Net Debt?

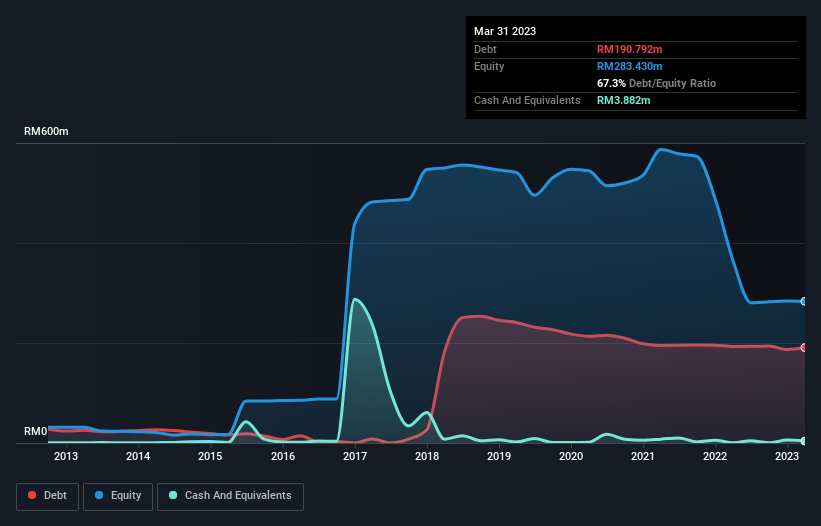

The chart below, which you can click on for greater detail, shows that Yong Tai Berhad had RM190.8m in debt in March 2023; about the same as the year before. On the flip side, it has RM3.88m in cash leading to net debt of about RM186.9m.

How Strong Is Yong Tai Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Yong Tai Berhad had liabilities of RM317.8m due within 12 months and liabilities of RM143.0m due beyond that. Offsetting these obligations, it had cash of RM3.88m as well as receivables valued at RM125.4m due within 12 months. So its liabilities total RM331.6m more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the RM172.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Yong Tai Berhad would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Yong Tai Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Yong Tai Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 158%, to RM147m. So its pretty obvious shareholders are hoping for more growth!

Caveat Emptor

While we can certainly appreciate Yong Tai Berhad's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Its EBIT loss was a whopping RM315m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of RM41m over the last twelve months. That means it's on the risky side of things. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 5 warning signs for Yong Tai Berhad (3 are concerning!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YONGTAI

Yong Tai Berhad

An investment holding company, engages in the tourism-related property development business in Malaysia.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026