- Malaysia

- /

- Real Estate

- /

- KLSE:MENANG

Should You Be Adding Menang Corporation (M) Berhad (KLSE:MENANG) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Menang Corporation (M) Berhad (KLSE:MENANG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Menang Corporation (M) Berhad

How Fast Is Menang Corporation (M) Berhad Growing Its Earnings Per Share?

In the last three years Menang Corporation (M) Berhad's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Menang Corporation (M) Berhad's EPS shot up from RM0.019 to RM0.028; a result that's bound to keep shareholders happy. That's a commendable gain of 45%.

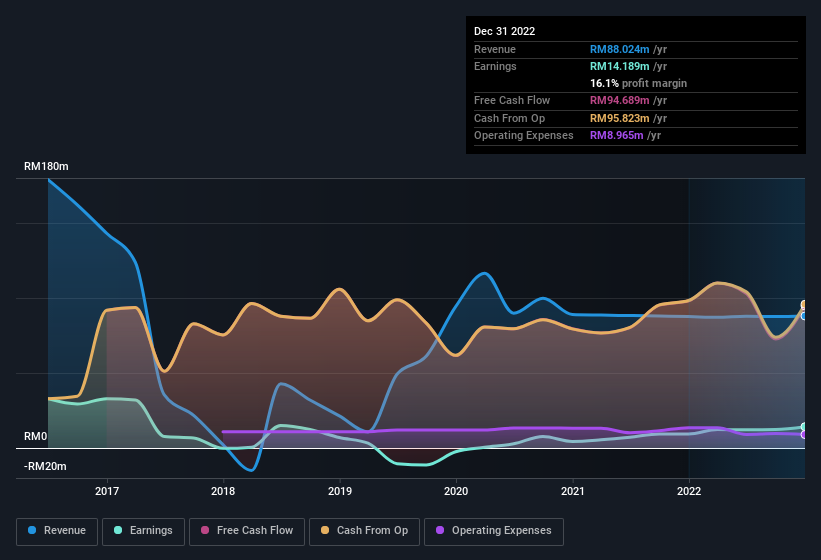

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins have declined for Menang Corporation (M) Berhad, but revenue stability should provide some reassurance to shareholders. Shareholders will be hopeful that the company can buck this trend.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Menang Corporation (M) Berhad is no giant, with a market capitalisation of RM357m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Menang Corporation (M) Berhad Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Menang Corporation (M) Berhad insiders own a meaningful share of the business. In fact, they own 45% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have RM161m invested in the business, at the current share price. That's nothing to sneeze at!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Menang Corporation (M) Berhad with market caps under RM888m is about RM481k.

The CEO of Menang Corporation (M) Berhad was paid just RM41k in total compensation for the year ending June 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Menang Corporation (M) Berhad Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Menang Corporation (M) Berhad's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Everyone has their own preferences when it comes to investing but it definitely makes Menang Corporation (M) Berhad look rather interesting indeed. We should say that we've discovered 4 warning signs for Menang Corporation (M) Berhad (2 are a bit unpleasant!) that you should be aware of before investing here.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MENANG

Menang Corporation (M) Berhad

An investment holding company, engages in the property development, investment, and construction activities in Malaysia.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives