- Malaysia

- /

- Real Estate

- /

- KLSE:L&G

Land & General Berhad (KLSE:L&G) Soars 29% But It's A Story Of Risk Vs Reward

Land & General Berhad (KLSE:L&G) shares have continued their recent momentum with a 29% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

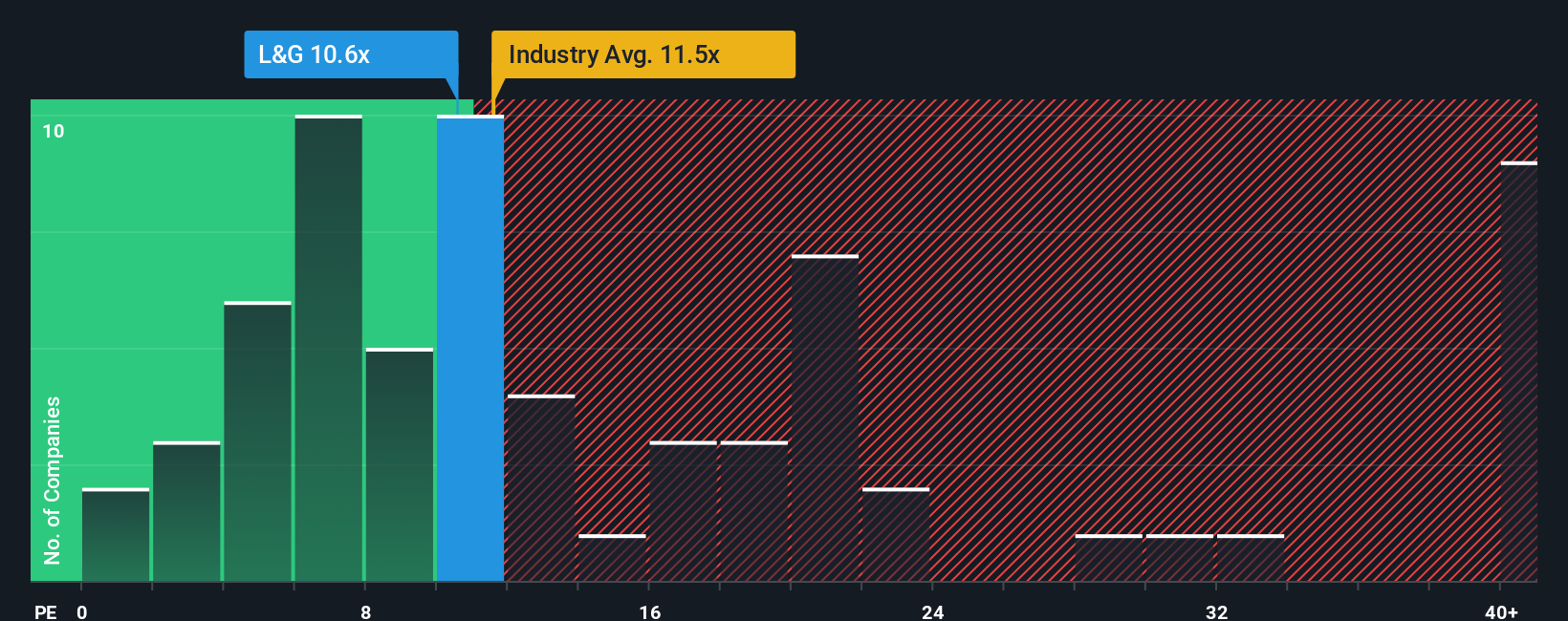

Although its price has surged higher, given about half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Land & General Berhad as an attractive investment with its 10.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for Land & General Berhad as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Land & General Berhad

How Is Land & General Berhad's Growth Trending?

In order to justify its P/E ratio, Land & General Berhad would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 63% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 206% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 15% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Land & General Berhad is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Land & General Berhad's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Land & General Berhad revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Land & General Berhad that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:L&G

Land & General Berhad

An investment holding company, engages in the property development business in Malaysia and Australia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives