- Malaysia

- /

- Real Estate

- /

- KLSE:KPPROP

Kerjaya Prospek Property Berhad's (KLSE:KPPROP) Shares Bounce 26% But Its Business Still Trails The Market

Kerjaya Prospek Property Berhad (KLSE:KPPROP) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 41% over that time.

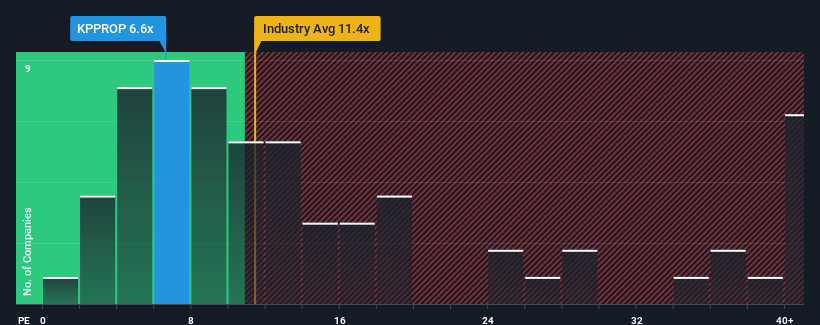

Although its price has surged higher, Kerjaya Prospek Property Berhad may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.6x, since almost half of all companies in Malaysia have P/E ratios greater than 14x and even P/E's higher than 25x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 2 warning signs investors should be aware of before investing in Kerjaya Prospek Property Berhad. Read for free now.For instance, Kerjaya Prospek Property Berhad's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Kerjaya Prospek Property Berhad

How Is Kerjaya Prospek Property Berhad's Growth Trending?

Kerjaya Prospek Property Berhad's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 68%. The last three years don't look nice either as the company has shrunk EPS by 65% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 16% shows it's an unpleasant look.

With this information, we are not surprised that Kerjaya Prospek Property Berhad is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Even after such a strong price move, Kerjaya Prospek Property Berhad's P/E still trails the rest of the market significantly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Kerjaya Prospek Property Berhad revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Kerjaya Prospek Property Berhad is showing 2 warning signs in our investment analysis, you should know about.

You might be able to find a better investment than Kerjaya Prospek Property Berhad. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kerjaya Prospek Property Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KPPROP

Kerjaya Prospek Property Berhad

Engages in property development and construction businesses in Malaysia.

Medium-low risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026