- Malaysia

- /

- Real Estate

- /

- KLSE:HUAYANG

Hua Yang Berhad's (KLSE:HUAYANG) Popularity With Investors Under Threat As Stock Sinks 26%

The Hua Yang Berhad (KLSE:HUAYANG) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

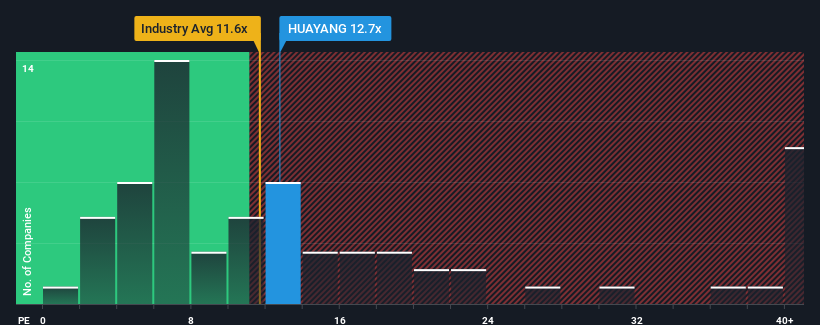

In spite of the heavy fall in price, there still wouldn't be many who think Hua Yang Berhad's price-to-earnings (or "P/E") ratio of 12.7x is worth a mention when the median P/E in Malaysia is similar at about 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

The recent earnings growth at Hua Yang Berhad would have to be considered satisfactory if not spectacular. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Hua Yang Berhad

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Hua Yang Berhad would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 3.7% gain to the company's bottom line. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Hua Yang Berhad's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Bottom Line On Hua Yang Berhad's P/E

Following Hua Yang Berhad's share price tumble, its P/E is now hanging on to the median market P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hua Yang Berhad currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 3 warning signs for Hua Yang Berhad (1 is significant!) that you need to take into consideration.

If you're unsure about the strength of Hua Yang Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hua Yang Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HUAYANG

Hua Yang Berhad

An investment holding company, engages in the property development business in Malaysia.

Acceptable track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026