David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Golden Land Berhad (KLSE:GLBHD) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

How Much Debt Does Golden Land Berhad Carry?

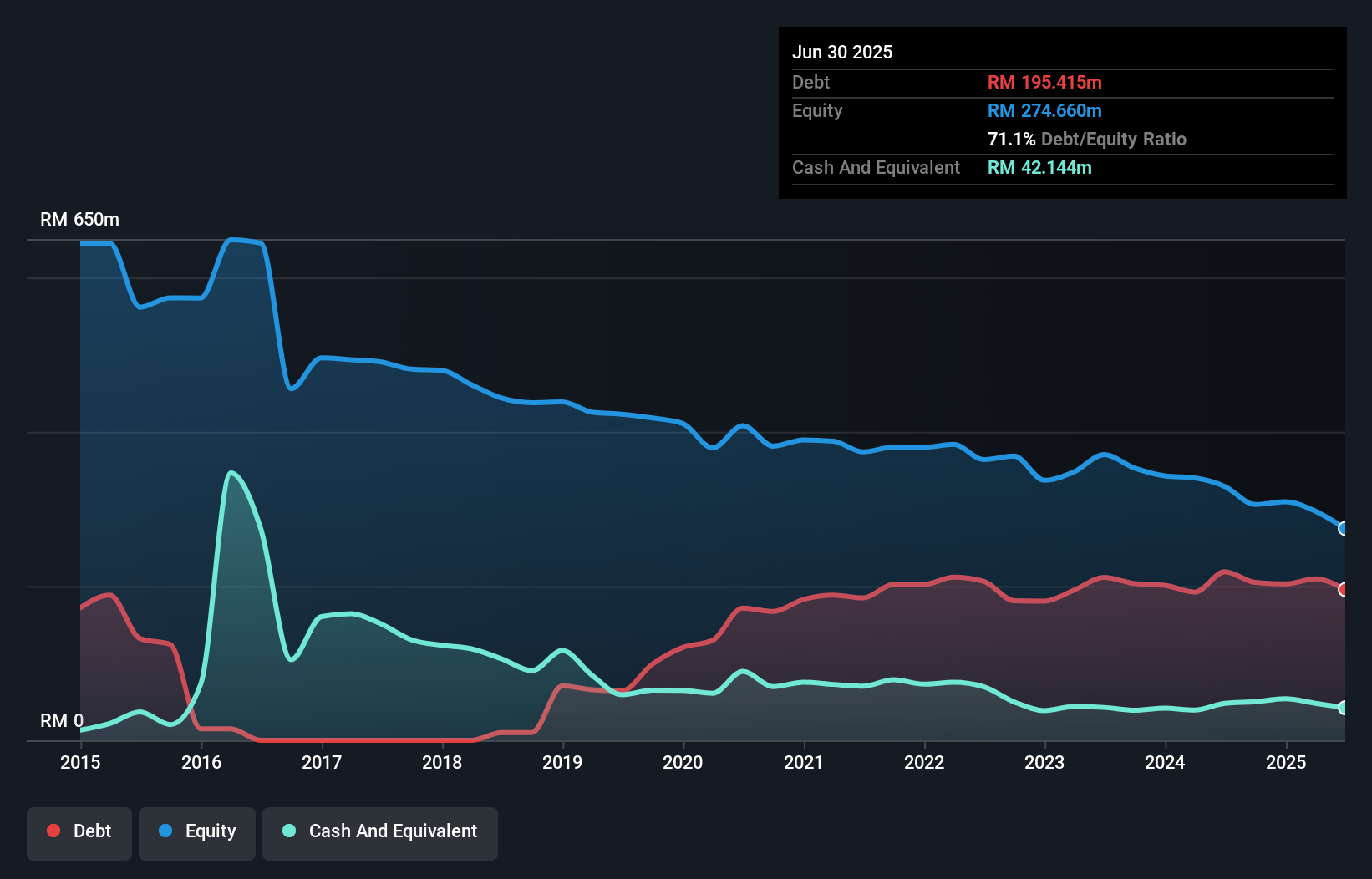

The image below, which you can click on for greater detail, shows that Golden Land Berhad had debt of RM195.4m at the end of June 2025, a reduction from RM218.5m over a year. However, it does have RM42.1m in cash offsetting this, leading to net debt of about RM153.3m.

A Look At Golden Land Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that Golden Land Berhad had liabilities of RM262.0m due within 12 months and liabilities of RM39.2m due beyond that. Offsetting this, it had RM42.1m in cash and RM43.5m in receivables that were due within 12 months. So its liabilities total RM215.5m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the RM56.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Golden Land Berhad would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Golden Land Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

View our latest analysis for Golden Land Berhad

In the last year Golden Land Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 33%, to RM173m. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Even though Golden Land Berhad managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. To be specific the EBIT loss came in at RM1.8m. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely since it is low on liquid assets, and made a loss of RM9.6m in the last year. So while it's not wise to assume the company will fail, we do think it's risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Golden Land Berhad (of which 1 is significant!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:GLBHD

Golden Land Berhad

An investment holding company, engages in the plantation and property development business in Malaysia and Indonesia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives