Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies ACME Holdings Berhad (KLSE:ACME) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for ACME Holdings Berhad

What Is ACME Holdings Berhad's Debt?

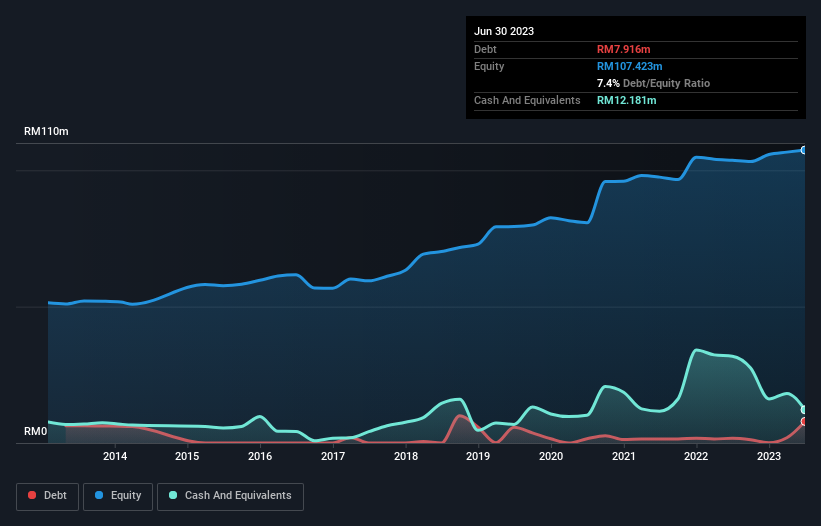

As you can see below, at the end of June 2023, ACME Holdings Berhad had RM7.92m of debt, up from RM1.72m a year ago. Click the image for more detail. However, its balance sheet shows it holds RM12.2m in cash, so it actually has RM4.27m net cash.

How Healthy Is ACME Holdings Berhad's Balance Sheet?

We can see from the most recent balance sheet that ACME Holdings Berhad had liabilities of RM21.4m falling due within a year, and liabilities of RM1.54m due beyond that. On the other hand, it had cash of RM12.2m and RM41.4m worth of receivables due within a year. So it actually has RM30.7m more liquid assets than total liabilities.

This excess liquidity is a great indication that ACME Holdings Berhad's balance sheet is almost as strong as Fort Knox. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that ACME Holdings Berhad has more cash than debt is arguably a good indication that it can manage its debt safely.

It was also good to see that despite losing money on the EBIT line last year, ACME Holdings Berhad turned things around in the last 12 months, delivering and EBIT of RM2.1m. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since ACME Holdings Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While ACME Holdings Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last year, ACME Holdings Berhad saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that ACME Holdings Berhad has net cash of RM4.27m, as well as more liquid assets than liabilities. So we don't have any problem with ACME Holdings Berhad's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with ACME Holdings Berhad (including 2 which make us uncomfortable) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ACME

ACME Holdings Berhad

An investment holding company, engages in the housing and property development business in Malaysia.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success