Most Shareholders Will Probably Find That The Compensation For Sasbadi Holdings Berhad's (KLSE:SASBADI) CEO Is Reasonable

Shareholders may be wondering what CEO King Hui Law plans to do to improve the less than great performance at Sasbadi Holdings Berhad (KLSE:SASBADI) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 16 February 2022. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for Sasbadi Holdings Berhad

Comparing Sasbadi Holdings Berhad's CEO Compensation With the industry

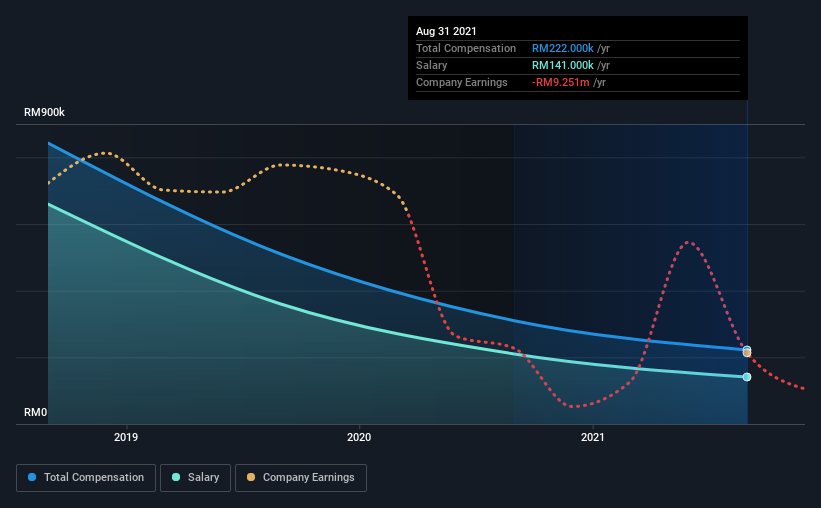

At the time of writing, our data shows that Sasbadi Holdings Berhad has a market capitalization of RM55m, and reported total annual CEO compensation of RM222k for the year to August 2021. We note that's a decrease of 28% compared to last year. We note that the salary portion, which stands at RM141.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under RM837m, the reported median total CEO compensation was RM721k. Accordingly, Sasbadi Holdings Berhad pays its CEO under the industry median. Furthermore, King Hui Law directly owns RM11m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | RM141k | RM210k | 64% |

| Other | RM81k | RM100k | 36% |

| Total Compensation | RM222k | RM310k | 100% |

Speaking on an industry level, nearly 96% of total compensation represents salary, while the remainder of 4% is other remuneration. It's interesting to note that Sasbadi Holdings Berhad allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Sasbadi Holdings Berhad's Growth

Over the last three years, Sasbadi Holdings Berhad has shrunk its earnings per share by 90% per year. Its revenue is up 17% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Sasbadi Holdings Berhad Been A Good Investment?

The return of -42% over three years would not have pleased Sasbadi Holdings Berhad shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders are sitting on a loss is certainly disheartening. The downward trend in share price performance may be attributable to the the fact that earnings growth has gone backwards. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Sasbadi Holdings Berhad you should be aware of, and 1 of them shouldn't be ignored.

Switching gears from Sasbadi Holdings Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SASBADI

Sasbadi Holdings Berhad

An investment holding company, publishes books and educational materials primarily in Malaysia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives