A Look At Sasbadi Holdings Berhad's (KLSE:SASBADI) CEO Remuneration

This article will reflect on the compensation paid to King Law who has served as CEO of Sasbadi Holdings Berhad (KLSE:SASBADI) since 2013. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Sasbadi Holdings Berhad.

View our latest analysis for Sasbadi Holdings Berhad

How Does Total Compensation For King Law Compare With Other Companies In The Industry?

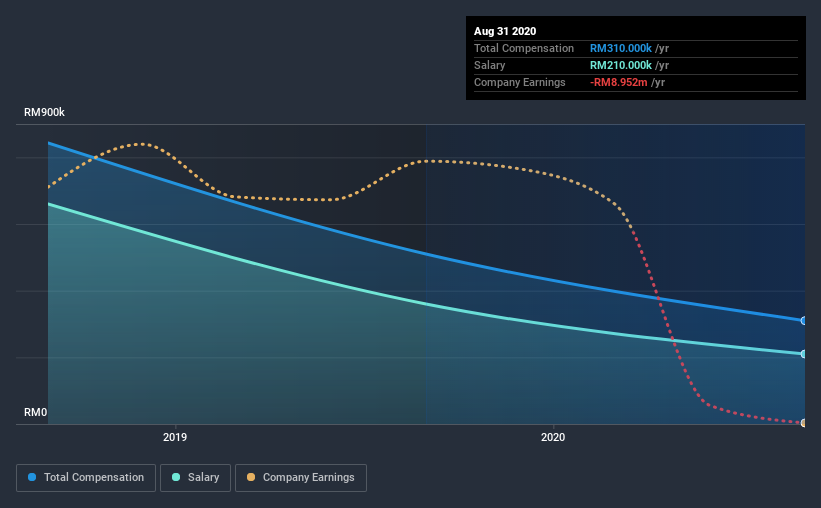

According to our data, Sasbadi Holdings Berhad has a market capitalization of RM63m, and paid its CEO total annual compensation worth RM310k over the year to August 2020. We note that's a decrease of 39% compared to last year. We note that the salary portion, which stands at RM210.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below RM804m, reported a median total CEO compensation of RM795k. Accordingly, Sasbadi Holdings Berhad pays its CEO under the industry median. What's more, King Law holds RM12m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM210k | RM360k | 68% |

| Other | RM100k | RM150k | 32% |

| Total Compensation | RM310k | RM510k | 100% |

On an industry level, around 90% of total compensation represents salary and 9.7% is other remuneration. Sasbadi Holdings Berhad sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Sasbadi Holdings Berhad's Growth Numbers

Over the last three years, Sasbadi Holdings Berhad has shrunk its earnings per share by 97% per year. Its revenue is down 29% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Sasbadi Holdings Berhad Been A Good Investment?

With a three year total loss of 74% for the shareholders, Sasbadi Holdings Berhad would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we noted earlier, Sasbadi Holdings Berhad pays its CEO lower than the norm for similar-sized companies belonging to the same industry. Over the last three years, shareholder returns have been downright disappointing, and EPSgrowth has been equally disappointing. It's tough to say that King is earning a very high compensation, but shareholders will likely want to see healthier investor returns before agreeing that a raise is in order.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Sasbadi Holdings Berhad you should be aware of, and 1 of them is a bit concerning.

Important note: Sasbadi Holdings Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Sasbadi Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SASBADI

Sasbadi Holdings Berhad

An investment holding company, publishes books and educational materials primarily in Malaysia.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion