- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:WTK

Is W T K Holdings Berhad (KLSE:WTK) Weighed On By Its Debt Load?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that W T K Holdings Berhad (KLSE:WTK) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for W T K Holdings Berhad

What Is W T K Holdings Berhad's Debt?

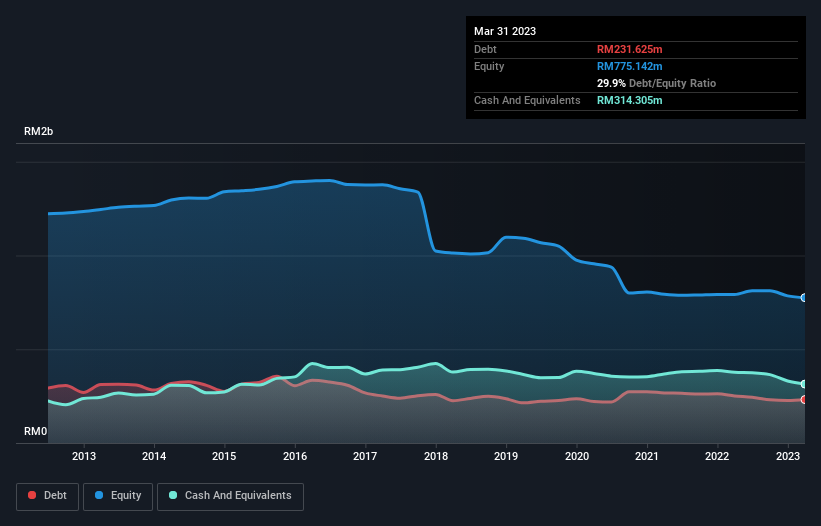

The image below, which you can click on for greater detail, shows that W T K Holdings Berhad had debt of RM231.6m at the end of March 2023, a reduction from RM251.0m over a year. However, it does have RM314.3m in cash offsetting this, leading to net cash of RM82.7m.

How Strong Is W T K Holdings Berhad's Balance Sheet?

According to the last reported balance sheet, W T K Holdings Berhad had liabilities of RM208.6m due within 12 months, and liabilities of RM140.0m due beyond 12 months. Offsetting these obligations, it had cash of RM314.3m as well as receivables valued at RM78.3m due within 12 months. So it can boast RM43.9m more liquid assets than total liabilities.

It's good to see that W T K Holdings Berhad has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, W T K Holdings Berhad boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since W T K Holdings Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, W T K Holdings Berhad reported revenue of RM477m, which is a gain of 16%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is W T K Holdings Berhad?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year W T K Holdings Berhad had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through RM20m of cash and made a loss of RM13m. Given it only has net cash of RM82.7m, the company may need to raise more capital if it doesn't reach break-even soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with W T K Holdings Berhad (including 1 which is potentially serious) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if W T K Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WTK

W T K Holdings Berhad

An investment holding company, operates in the timber industry in Malaysia, Japan, Singapore, Taiwan, Australia, Thailand, and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives