Stock Analysis

- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:UPA

Here's Why We're Wary Of Buying UPA Corporation Berhad's (KLSE:UPA) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that UPA Corporation Berhad (KLSE:UPA) is about to go ex-dividend in just 3 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Meaning, you will need to purchase UPA Corporation Berhad's shares before the 4th of July to receive the dividend, which will be paid on the 19th of July.

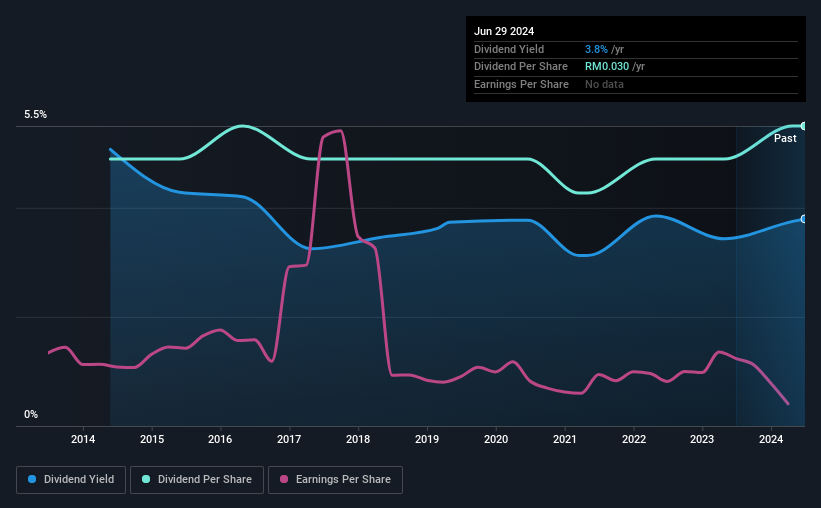

The company's upcoming dividend is RM00.03 a share, following on from the last 12 months, when the company distributed a total of RM0.03 per share to shareholders. Based on the last year's worth of payments, UPA Corporation Berhad stock has a trailing yield of around 3.8% on the current share price of RM00.79. If you buy this business for its dividend, you should have an idea of whether UPA Corporation Berhad's dividend is reliable and sustainable. As a result, readers should always check whether UPA Corporation Berhad has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for UPA Corporation Berhad

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. UPA Corporation Berhad paid out 156% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 20% of its free cash flow as dividends last year, which is conservatively low.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and UPA Corporation Berhad fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see how much of its profit UPA Corporation Berhad paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. UPA Corporation Berhad's earnings per share have fallen at approximately 13% a year over the previous five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, UPA Corporation Berhad has increased its dividend at approximately 1.2% a year on average.

Final Takeaway

Has UPA Corporation Berhad got what it takes to maintain its dividend payments? It's never great to see earnings per share declining, especially when a company is paying out 156% of its profit as dividends, which we feel is uncomfortably high. However, the cash payout ratio was much lower - good news from a dividend perspective - which makes us wonder why there is such a mis-match between income and cashflow. It's not that we think UPA Corporation Berhad is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

Although, if you're still interested in UPA Corporation Berhad and want to know more, you'll find it very useful to know what risks this stock faces. Our analysis shows 3 warning signs for UPA Corporation Berhad and you should be aware of these before buying any shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're helping make it simple.

Find out whether UPA Corporation Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether UPA Corporation Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:UPA

UPA Corporation Berhad

An investment holding company, manufactures and sells paper-based and plastic products in Malaysia, North America, Europe, and the Asia Pacific.

Flawless balance sheet average dividend payer.