- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:TOPMIX

Topmix Berhad's (KLSE:TOPMIX) Price Is Out Of Tune With Revenues

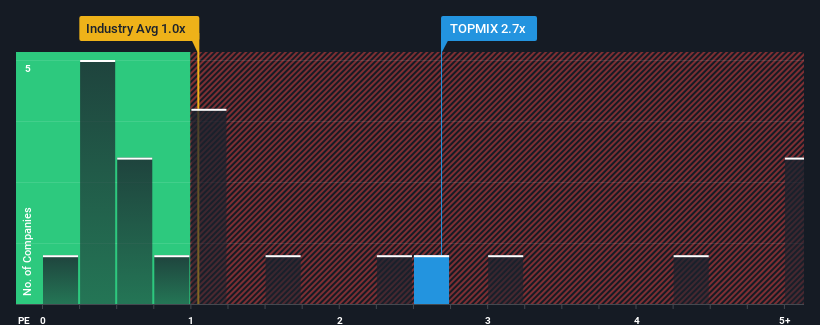

Topmix Berhad's (KLSE:TOPMIX) price-to-sales (or "P/S") ratio of 2.7x may not look like an appealing investment opportunity when you consider close to half the companies in the Forestry industry in Malaysia have P/S ratios below 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Topmix Berhad

How Topmix Berhad Has Been Performing

With revenue growth that's superior to most other companies of late, Topmix Berhad has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Topmix Berhad.Is There Enough Revenue Growth Forecasted For Topmix Berhad?

Topmix Berhad's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. Pleasingly, revenue has also lifted 164% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 13%, which is not materially different.

With this information, we find it interesting that Topmix Berhad is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Topmix Berhad's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Topmix Berhad's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 2 warning signs for Topmix Berhad (1 doesn't sit too well with us!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Topmix Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TOPMIX

Topmix Berhad

An investment holding company, engages in the marketing and sale of decorative surface products and accessories in Malaysia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives