Broker Revenue Forecasts For Thong Guan Industries Berhad (KLSE:TGUAN) Are Surging Higher

Shareholders in Thong Guan Industries Berhad (KLSE:TGUAN) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline.

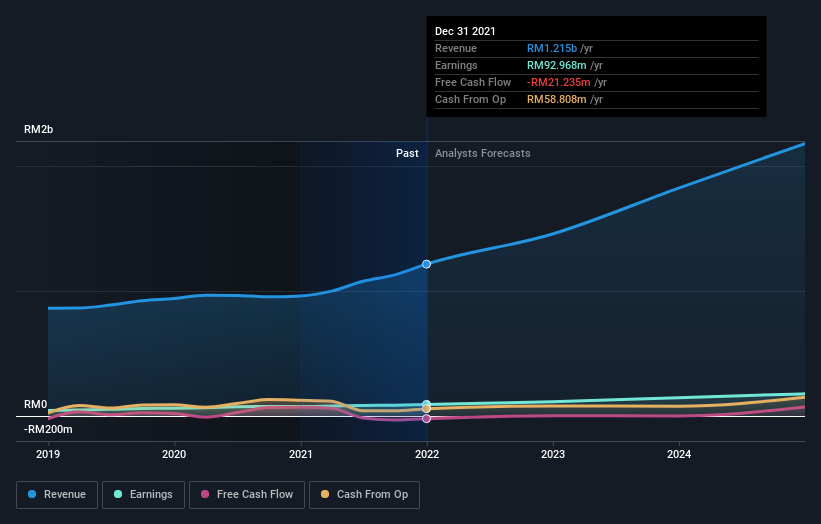

After the upgrade, the twin analysts covering Thong Guan Industries Berhad are now predicting revenues of RM1.5b in 2022. If met, this would reflect a meaningful 20% improvement in sales compared to the last 12 months. Per-share earnings are expected to bounce 22% to RM0.29. Before this latest update, the analysts had been forecasting revenues of RM1.3b and earnings per share (EPS) of RM0.27 in 2022. The most recent forecasts are noticeably more optimistic, with a decent improvement in revenue estimates and a lift to earnings per share as well.

Check out our latest analysis for Thong Guan Industries Berhad

With these upgrades, we're not surprised to see that the analysts have lifted their price target 5.3% to RM4.80 per share. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Thong Guan Industries Berhad analyst has a price target of RM5.70 per share, while the most pessimistic values it at RM3.90. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Thong Guan Industries Berhad's growth to accelerate, with the forecast 20% annualised growth to the end of 2022 ranking favourably alongside historical growth of 7.9% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Thong Guan Industries Berhad is expected to grow much faster than its industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Thong Guan Industries Berhad.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Thong Guan Industries Berhad going out as far as 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Thong Guan Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TGUAN

Thong Guan Industries Berhad

An investment holding company, manufactures and trades in plastic products and packaged food, beverages, and other consumable products in Malaysia, other Asian countries, Oceania, Europe, North America, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives