- Malaysia

- /

- Metals and Mining

- /

- KLSE:MAYU

Mayu Global Group Berhad (KLSE:MAYU) Stock Catapults 30% Though Its Price And Business Still Lag The Market

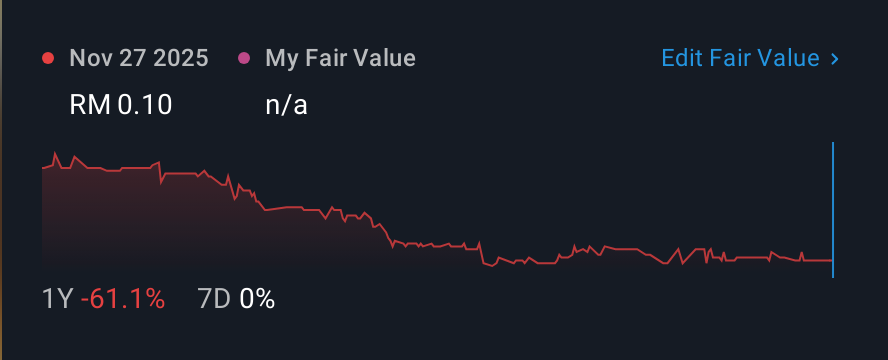

Mayu Global Group Berhad (KLSE:MAYU) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 57% share price decline over the last year.

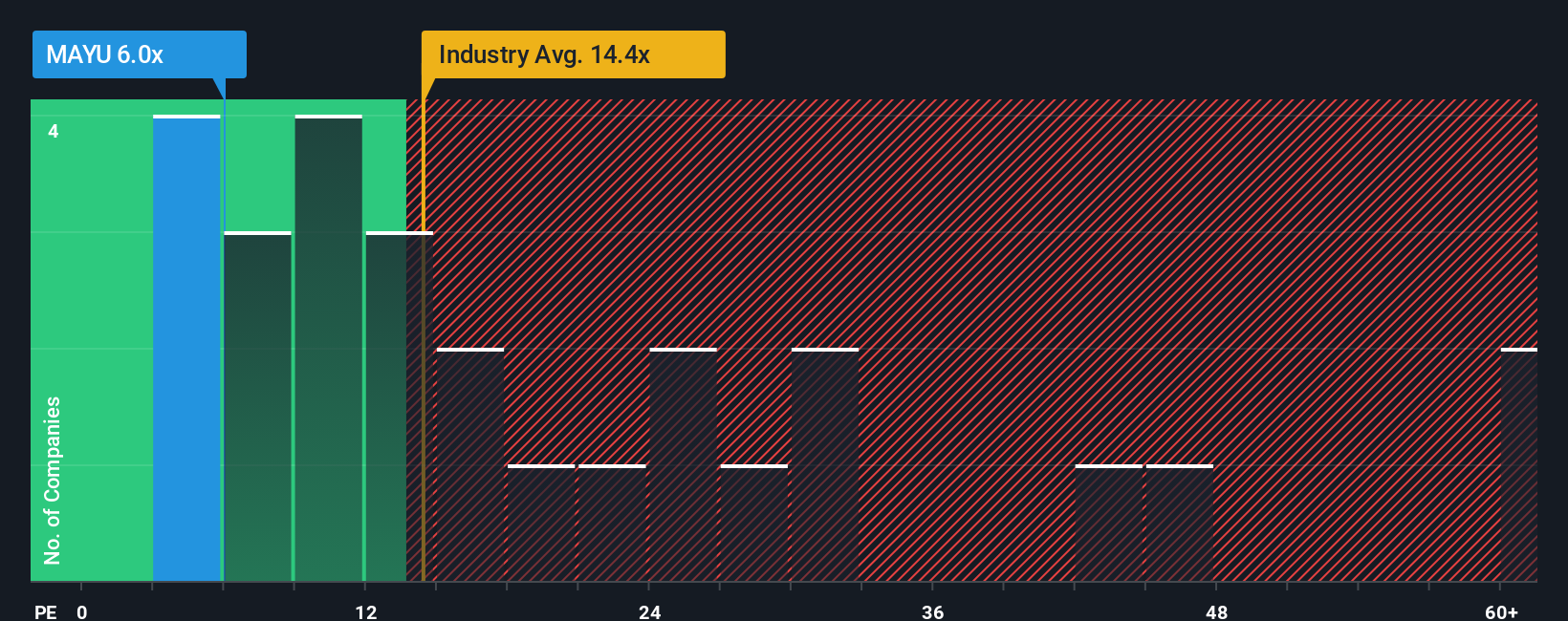

In spite of the firm bounce in price, given about half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Mayu Global Group Berhad as a highly attractive investment with its 6x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Mayu Global Group Berhad over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Mayu Global Group Berhad

How Is Mayu Global Group Berhad's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Mayu Global Group Berhad's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 8.0% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 14% shows it's an unpleasant look.

In light of this, it's understandable that Mayu Global Group Berhad's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Mayu Global Group Berhad's P/E

Mayu Global Group Berhad's recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Mayu Global Group Berhad revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Mayu Global Group Berhad (including 1 which shouldn't be ignored).

Of course, you might also be able to find a better stock than Mayu Global Group Berhad. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MAYU

Mayu Global Group Berhad

An investment holding company, manufactures, processes, and trades in steel and metal related products in Malaysia and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success