- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:MAXLAND

Is Maxland Berhad (KLSE:MAXLAND) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Maxland Berhad (KLSE:MAXLAND) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Maxland Berhad

What Is Maxland Berhad's Debt?

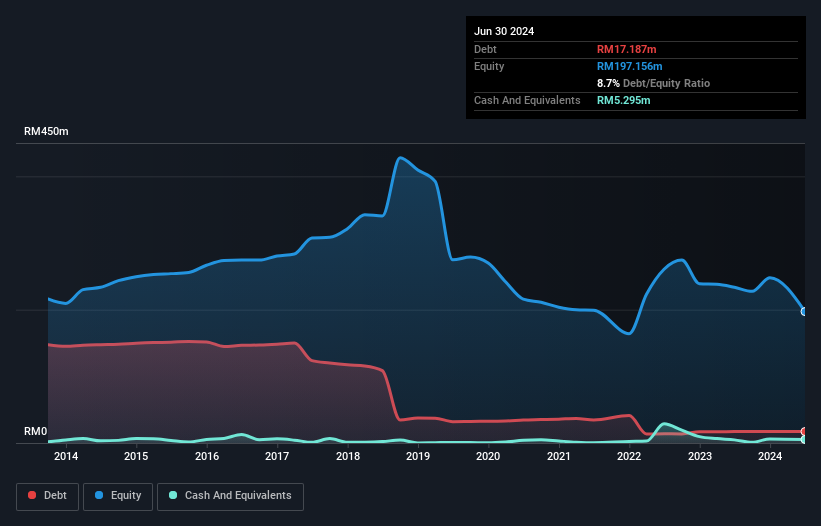

The chart below, which you can click on for greater detail, shows that Maxland Berhad had RM17.2m in debt in June 2024; about the same as the year before. On the flip side, it has RM5.30m in cash leading to net debt of about RM11.9m.

How Healthy Is Maxland Berhad's Balance Sheet?

The latest balance sheet data shows that Maxland Berhad had liabilities of RM117.6m due within a year, and liabilities of RM30.0m falling due after that. Offsetting this, it had RM5.30m in cash and RM23.9m in receivables that were due within 12 months. So its liabilities total RM118.4m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of RM136.3m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. When analysing debt levels, the balance sheet is the obvious place to start. But it is Maxland Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Maxland Berhad reported revenue of RM76m, which is a gain of 25%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Despite the top line growth, Maxland Berhad still had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping RM80m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through RM15m of cash over the last year. So in short it's a really risky stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Maxland Berhad has 4 warning signs (and 2 which make us uncomfortable) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MAXLAND

Maxland Berhad

An investment holding company, manufactures and sells wood products in Malaysia, Japan, Taiwan, Korea, India, and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026