- Malaysia

- /

- Metals and Mining

- /

- KLSE:MASTEEL

There's Reason For Concern Over Malaysia Steel Works (KL) Bhd.'s (KLSE:MASTEEL) Price

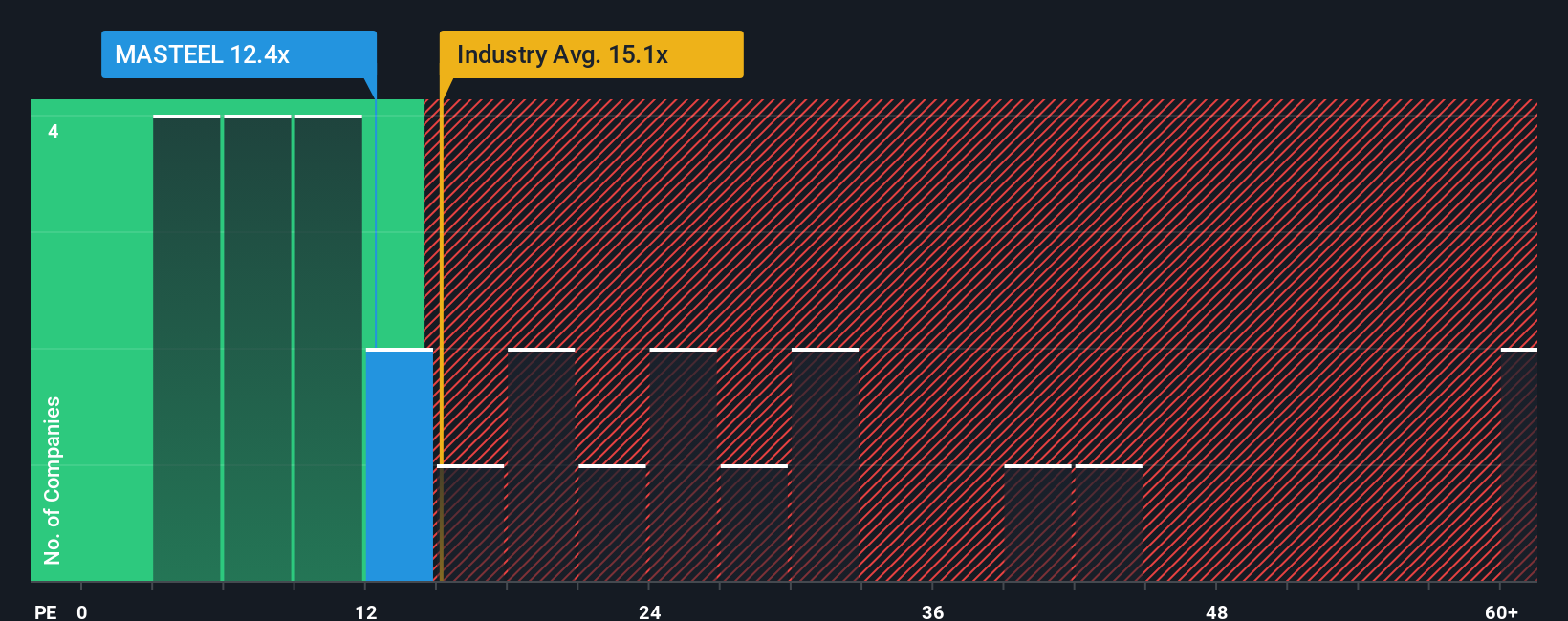

With a median price-to-earnings (or "P/E") ratio of close to 14x in Malaysia, you could be forgiven for feeling indifferent about Malaysia Steel Works (KL) Bhd.'s (KLSE:MASTEEL) P/E ratio of 12.4x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Malaysia Steel Works (KL) Bhd as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Malaysia Steel Works (KL) Bhd

Is There Some Growth For Malaysia Steel Works (KL) Bhd?

In order to justify its P/E ratio, Malaysia Steel Works (KL) Bhd would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 191% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 59% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 15% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's somewhat alarming that Malaysia Steel Works (KL) Bhd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Malaysia Steel Works (KL) Bhd revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Malaysia Steel Works (KL) Bhd has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MASTEEL

Malaysia Steel Works (KL) Bhd

Manufactures and markets tensile steel bars, mild steel bars, and prime steel billets for the construction and infrastructure sectors in Malaysia and internationally.

Solid track record and slightly overvalued.

Market Insights

Community Narratives