- Malaysia

- /

- Metals and Mining

- /

- KLSE:LYSAGHT

Lysaght Galvanized Steel Berhad's (KLSE:LYSAGHT) CEO Might Not Expect Shareholders To Be So Generous This Year

Lysaght Galvanized Steel Berhad (KLSE:LYSAGHT) has not performed well recently and CEO Tia Chua will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 17 June 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Lysaght Galvanized Steel Berhad

Comparing Lysaght Galvanized Steel Berhad's CEO Compensation With the industry

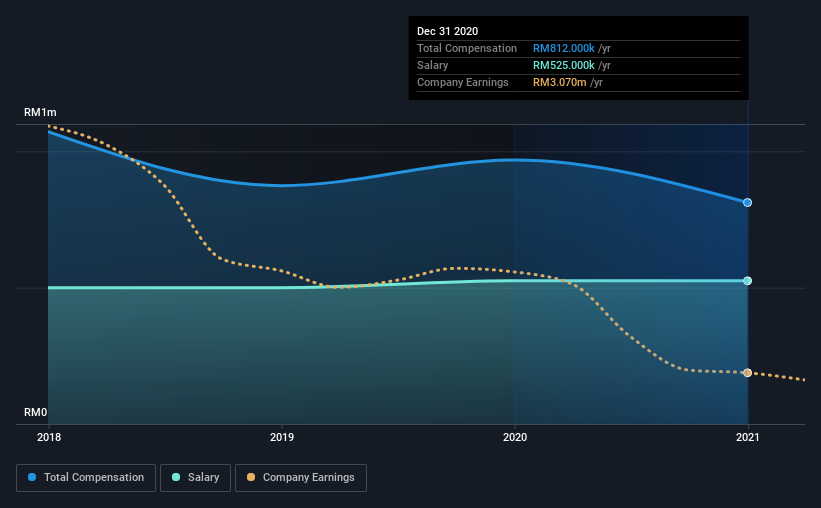

Our data indicates that Lysaght Galvanized Steel Berhad has a market capitalization of RM91m, and total annual CEO compensation was reported as RM812k for the year to December 2020. Notably, that's a decrease of 16% over the year before. We note that the salary portion, which stands at RM525.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below RM824m, we found that the median total CEO compensation was RM680k. From this we gather that Tia Chua is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM525k | RM525k | 65% |

| Other | RM287k | RM443k | 35% |

| Total Compensation | RM812k | RM968k | 100% |

Speaking on an industry level, nearly 78% of total compensation represents salary, while the remainder of 22% is other remuneration. It's interesting to note that Lysaght Galvanized Steel Berhad allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Lysaght Galvanized Steel Berhad's Growth Numbers

Lysaght Galvanized Steel Berhad has reduced its earnings per share by 46% a year over the last three years. In the last year, its revenue is down 25%.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Lysaght Galvanized Steel Berhad Been A Good Investment?

With a total shareholder return of -31% over three years, Lysaght Galvanized Steel Berhad shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Lysaght Galvanized Steel Berhad (of which 1 doesn't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LYSAGHT

Lysaght Galvanized Steel Berhad

Engages in manufacturing and selling galvanized steel products in Malaysia, Singapore, New Zealand, the United Arab Emirates, and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success