The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Leon Fuat Berhad (KLSE:LEONFB) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Leon Fuat Berhad

What Is Leon Fuat Berhad's Net Debt?

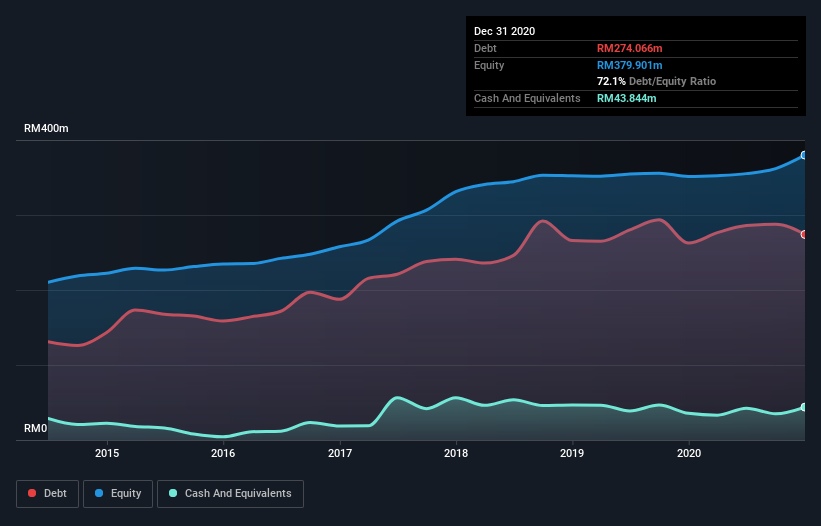

The image below, which you can click on for greater detail, shows that at December 2020 Leon Fuat Berhad had debt of RM274.1m, up from RM262.5m in one year. However, because it has a cash reserve of RM43.8m, its net debt is less, at about RM230.2m.

How Strong Is Leon Fuat Berhad's Balance Sheet?

According to the last reported balance sheet, Leon Fuat Berhad had liabilities of RM283.3m due within 12 months, and liabilities of RM68.1m due beyond 12 months. Offsetting this, it had RM43.8m in cash and RM201.4m in receivables that were due within 12 months. So its liabilities total RM106.2m more than the combination of its cash and short-term receivables.

Leon Fuat Berhad has a market capitalization of RM358.1m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Leon Fuat Berhad's debt is 3.9 times its EBITDA, and its EBIT cover its interest expense 3.9 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Looking on the bright side, Leon Fuat Berhad boosted its EBIT by a silky 79% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Leon Fuat Berhad can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Leon Fuat Berhad created free cash flow amounting to 2.9% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Neither Leon Fuat Berhad's ability to convert EBIT to free cash flow nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But its EBIT growth rate tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that Leon Fuat Berhad is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 5 warning signs for Leon Fuat Berhad (of which 2 don't sit too well with us!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LEONFB

Leon Fuat Berhad

An investment holding company, processes and trades in steel products in Malaysia.

Moderate risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives