Revenues Working Against Lotte Chemical Titan Holding Berhad's (KLSE:LCTITAN) Share Price Following 26% Dive

Lotte Chemical Titan Holding Berhad (KLSE:LCTITAN) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

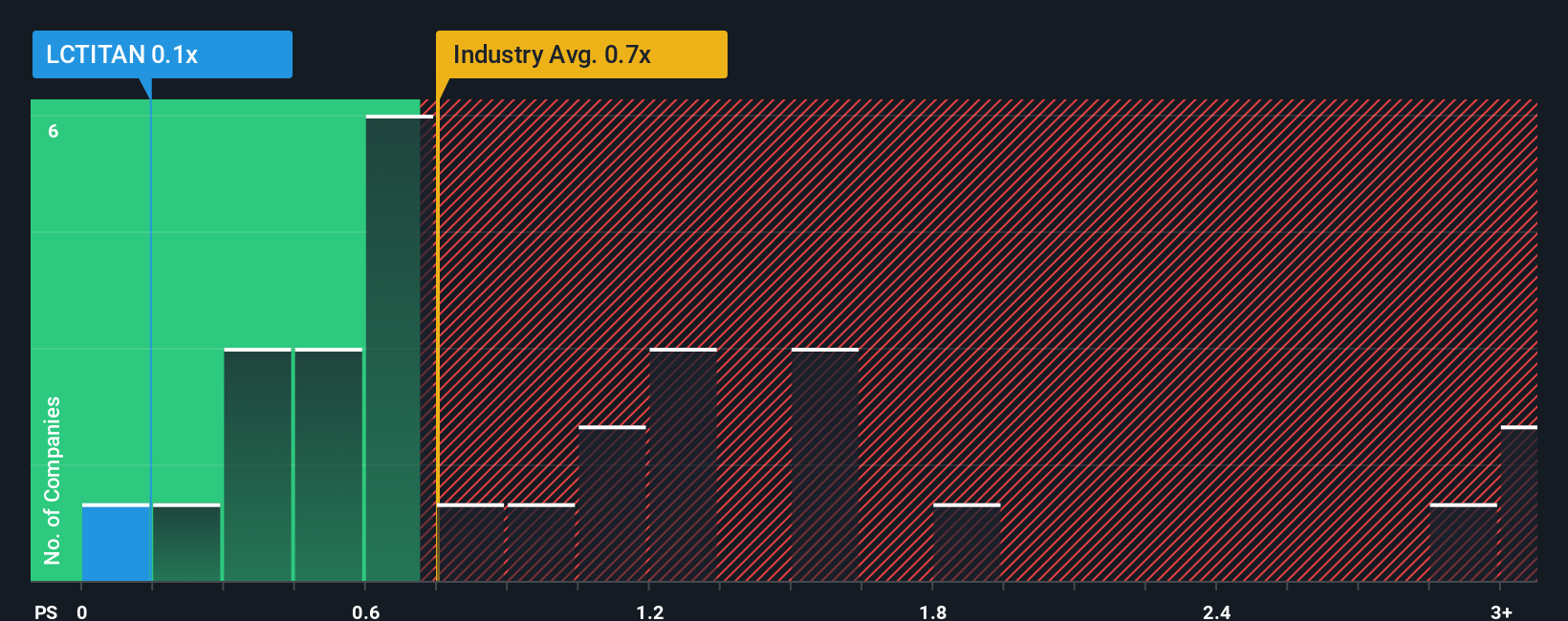

After such a large drop in price, given about half the companies operating in Malaysia's Chemicals industry have price-to-sales ratios (or "P/S") above 0.7x, you may consider Lotte Chemical Titan Holding Berhad as an attractive investment with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Lotte Chemical Titan Holding Berhad

What Does Lotte Chemical Titan Holding Berhad's P/S Mean For Shareholders?

The recently shrinking revenue for Lotte Chemical Titan Holding Berhad has been in line with the industry. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Keen to find out how analysts think Lotte Chemical Titan Holding Berhad's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Lotte Chemical Titan Holding Berhad's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.4%. This means it has also seen a slide in revenue over the longer-term as revenue is down 33% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 1.4% during the coming year according to the three analysts following the company. That's not great when the rest of the industry is expected to grow by 11%.

With this in consideration, we find it intriguing that Lotte Chemical Titan Holding Berhad's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Lotte Chemical Titan Holding Berhad's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Lotte Chemical Titan Holding Berhad maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It is also worth noting that we have found 2 warning signs for Lotte Chemical Titan Holding Berhad that you need to take into consideration.

If you're unsure about the strength of Lotte Chemical Titan Holding Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LCTITAN

Lotte Chemical Titan Holding Berhad

Manufactures and sells petrochemical products and polyolefin resins in Malaysia, Indonesia, China, Southeast Asia, Northeast Asia, Indian Sub-Continent, and internationally.

Undervalued with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success