Returns At Karyon Industries Berhad (KLSE:KARYON) Appear To Be Weighed Down

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Although, when we looked at Karyon Industries Berhad (KLSE:KARYON), it didn't seem to tick all of these boxes.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Karyon Industries Berhad is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.075 = RM9.2m ÷ (RM140m - RM16m) (Based on the trailing twelve months to December 2022).

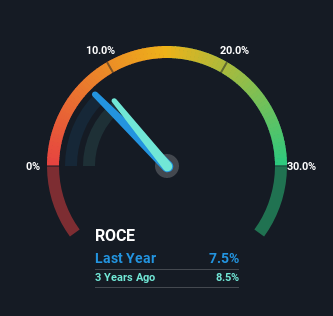

Thus, Karyon Industries Berhad has an ROCE of 7.5%. On its own that's a low return on capital but it's in line with the industry's average returns of 7.5%.

View our latest analysis for Karyon Industries Berhad

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Karyon Industries Berhad has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

There are better returns on capital out there than what we're seeing at Karyon Industries Berhad. The company has consistently earned 7.5% for the last five years, and the capital employed within the business has risen 22% in that time. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

Our Take On Karyon Industries Berhad's ROCE

As we've seen above, Karyon Industries Berhad's returns on capital haven't increased but it is reinvesting in the business. And with the stock having returned a mere 15% in the last five years to shareholders, you could argue that they're aware of these lackluster trends. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

If you want to know some of the risks facing Karyon Industries Berhad we've found 4 warning signs (1 is significant!) that you should be aware of before investing here.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Karyon Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KARYON

Karyon Industries Berhad

An investment holding company, manufactures and trades polymeric products in Malaysia, rest of Asia, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026