- Malaysia

- /

- Basic Materials

- /

- KLSE:HUMEIND

Even With A 30% Surge, Cautious Investors Are Not Rewarding Hume Cement Industries Berhad's (KLSE:HUMEIND) Performance Completely

Hume Cement Industries Berhad (KLSE:HUMEIND) shares have continued their recent momentum with a 30% gain in the last month alone. The last month tops off a massive increase of 195% in the last year.

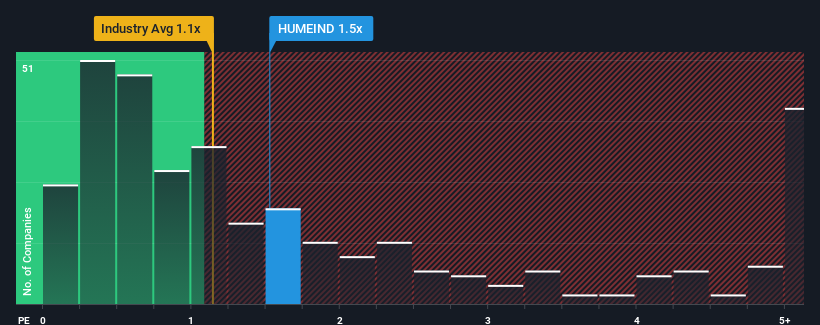

In spite of the firm bounce in price, there still wouldn't be many who think Hume Cement Industries Berhad's price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in Malaysia's Basic Materials industry is similar at about 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Hume Cement Industries Berhad

How Has Hume Cement Industries Berhad Performed Recently?

Recent times have been advantageous for Hume Cement Industries Berhad as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hume Cement Industries Berhad will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Hume Cement Industries Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 38% gain to the company's top line. The latest three year period has also seen an excellent 90% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 22% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 0.4%, which is noticeably less attractive.

With this information, we find it interesting that Hume Cement Industries Berhad is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Hume Cement Industries Berhad appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Hume Cement Industries Berhad currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Hume Cement Industries Berhad that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hume Cement Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HUMEIND

Hume Cement Industries Berhad

An investment holding company, manufactures and sells cement, concrete, and related products in Malaysia.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026