- Malaysia

- /

- Metals and Mining

- /

- KLSE:HIAPTEK

Does Hiap Teck Venture Berhad (KLSE:HIAPTEK) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Hiap Teck Venture Berhad (KLSE:HIAPTEK) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Hiap Teck Venture Berhad

How Much Debt Does Hiap Teck Venture Berhad Carry?

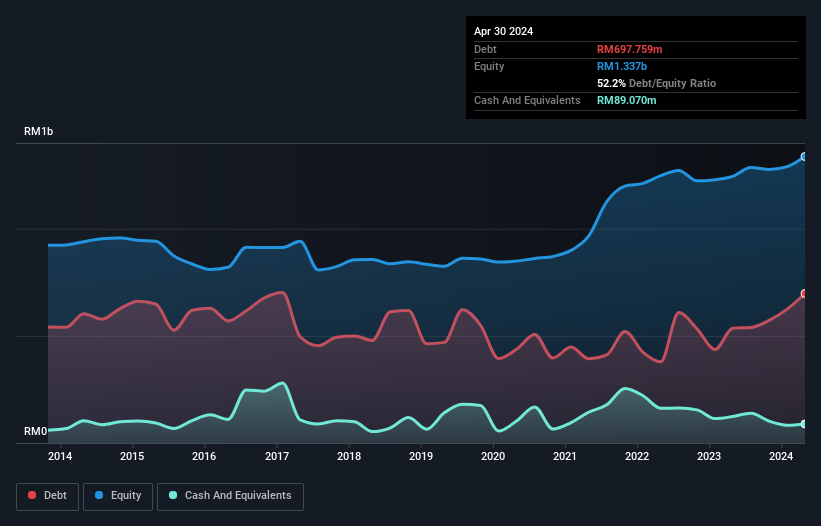

As you can see below, at the end of April 2024, Hiap Teck Venture Berhad had RM697.8m of debt, up from RM535.9m a year ago. Click the image for more detail. However, it also had RM89.1m in cash, and so its net debt is RM608.7m.

How Strong Is Hiap Teck Venture Berhad's Balance Sheet?

According to the last reported balance sheet, Hiap Teck Venture Berhad had liabilities of RM774.8m due within 12 months, and liabilities of RM12.4m due beyond 12 months. Offsetting these obligations, it had cash of RM89.1m as well as receivables valued at RM407.5m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM290.6m.

Hiap Teck Venture Berhad has a market capitalization of RM688.2m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hiap Teck Venture Berhad has a rather high debt to EBITDA ratio of 6.5 which suggests a meaningful debt load. However, its interest coverage of 3.4 is reasonably strong, which is a good sign. One redeeming factor for Hiap Teck Venture Berhad is that it turned last year's EBIT loss into a gain of RM76m, over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Hiap Teck Venture Berhad can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, Hiap Teck Venture Berhad burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Hiap Teck Venture Berhad's net debt to EBITDA and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. Having said that, its ability to grow its EBIT isn't such a worry. Overall, we think it's fair to say that Hiap Teck Venture Berhad has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with Hiap Teck Venture Berhad , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Hiap Teck Venture Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:HIAPTEK

Hiap Teck Venture Berhad

Manufactures, rents, distributes, and sells steel pipes, hollow sections, scaffolding equipment and accessories, and other steel products in Malaysia.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives