- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:EVERGRN

Investors Continue Waiting On Sidelines For Evergreen Fibreboard Berhad (KLSE:EVERGRN)

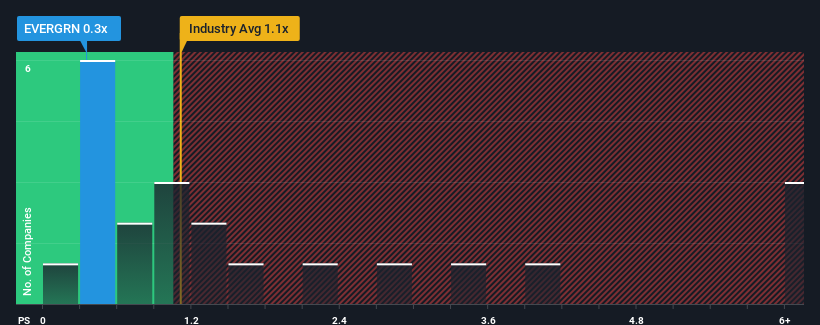

When close to half the companies operating in the Forestry industry in Malaysia have price-to-sales ratios (or "P/S") above 1.1x, you may consider Evergreen Fibreboard Berhad (KLSE:EVERGRN) as an attractive investment with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Evergreen Fibreboard Berhad

What Does Evergreen Fibreboard Berhad's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Evergreen Fibreboard Berhad's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Evergreen Fibreboard Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is Evergreen Fibreboard Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Evergreen Fibreboard Berhad's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.2% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 7.8% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 18% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Evergreen Fibreboard Berhad's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Evergreen Fibreboard Berhad currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Evergreen Fibreboard Berhad is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Evergreen Fibreboard Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:EVERGRN

Evergreen Fibreboard Berhad

Engages in the production and sale of engineered wood-based products.

Reasonable growth potential and fair value.

Market Insights

Community Narratives