- Malaysia

- /

- Basic Materials

- /

- KLSE:CMSB

Need To Know: The Consensus Just Cut Its Cahya Mata Sarawak Berhad (KLSE:CMSB) Estimates For 2021

Market forces rained on the parade of Cahya Mata Sarawak Berhad (KLSE:CMSB) shareholders today, when the analysts downgraded their forecasts for this year. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

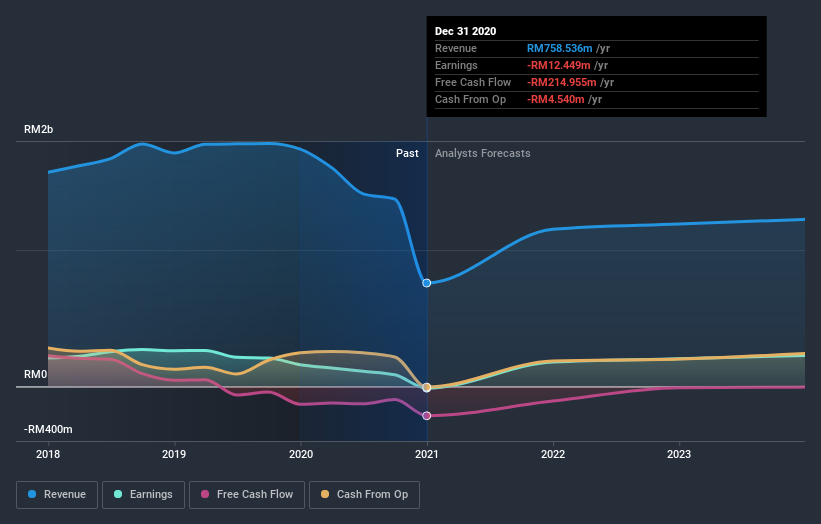

Following the downgrade, the most recent consensus for Cahya Mata Sarawak Berhad from its seven analysts is for revenues of RM1.2b in 2021 which, if met, would be a major 52% increase on its sales over the past 12 months. Before the latest update, the analysts were foreseeing RM1.3b of revenue in 2021. It looks like forecasts have become a fair bit less optimistic on Cahya Mata Sarawak Berhad, given the measurable cut to revenue estimates.

View our latest analysis for Cahya Mata Sarawak Berhad

The consensus price target rose 18% to RM2.58, with the analysts clearly more optimistic about Cahya Mata Sarawak Berhad's prospects following this update. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Cahya Mata Sarawak Berhad at RM2.90 per share, while the most bearish prices it at RM2.40. This is a very narrow spread of estimates, implying either that Cahya Mata Sarawak Berhad is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. For example, we noticed that Cahya Mata Sarawak Berhad's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 52% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 3.2% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 9.5% per year. Not only are Cahya Mata Sarawak Berhad's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Cahya Mata Sarawak Berhad this year. Analysts also expect revenues to grow faster than the wider market. There was also an increase in the price target, suggesting that there is more optimism baked into the forecasts than there was previously. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Cahya Mata Sarawak Berhad going forwards.

Still got questions? At least one of Cahya Mata Sarawak Berhad's seven analysts has provided estimates out to 2023, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Cahya Mata Sarawak Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CMSB

Cahya Mata Sarawak Berhad

An investment holding company, engages in the manufacture and trading of cement and construction materials in Malaysia and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives