- Malaysia

- /

- Metals and Mining

- /

- KLSE:CHOOBEE

Choo Bee Metal Industries Berhad's (KLSE:CHOOBEE) Shareholders Will Receive A Smaller Dividend Than Last Year

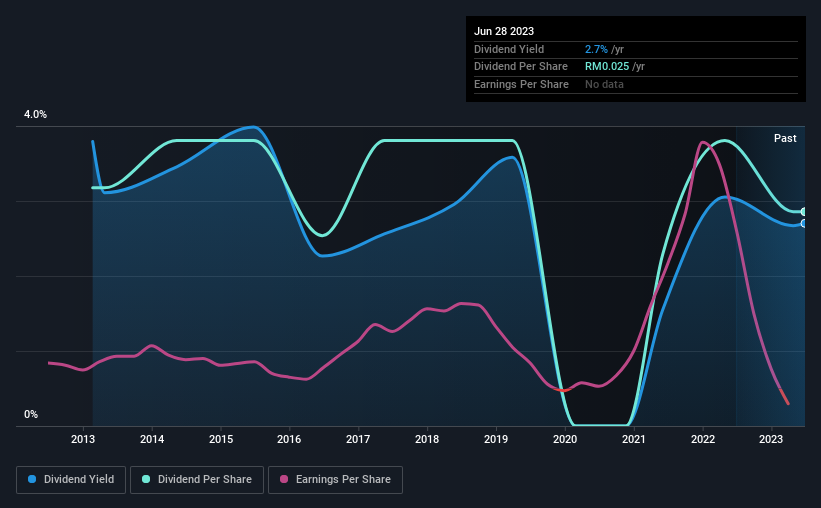

Choo Bee Metal Industries Berhad (KLSE:CHOOBEE) has announced that on 3rd of August, it will be paying a dividend ofMYR0.025, which a reduction from last year's comparable dividend. However, the dividend yield of 2.7% is still a decent boost to shareholder returns.

Check out our latest analysis for Choo Bee Metal Industries Berhad

Choo Bee Metal Industries Berhad's Distributions May Be Difficult To Sustain

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. While Choo Bee Metal Industries Berhad is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Over the next year, EPS could expand by 17.7% if recent trends continue. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. However, the positive cash flow ratio gives us some comfort about the sustainability of the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of MYR0.0278 in 2013 to the most recent total annual payment of MYR0.025. The dividend has shrunk at around 1.1% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Company Could Face Some Challenges Growing The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. We are encouraged to see that Choo Bee Metal Industries Berhad has grown earnings per share at 18% per year over the past five years. It's not great that the company is not turning a profit, but the decent growth in recent years is certainly a positive sign. If the company can become profitable soon, continuing on this trajectory would bode well for the future of the dividend.

Our Thoughts On Choo Bee Metal Industries Berhad's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 2 warning signs for Choo Bee Metal Industries Berhad that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CHOOBEE

Choo Bee Metal Industries Berhad

Manufactures and sells flat-based steel products in Malaysia and rest of Asia.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives