- Malaysia

- /

- Basic Materials

- /

- KLSE:CEPCO

Increases to CEO Compensation Might Be Put On Hold For Now at Concrete Engineering Products Berhad (KLSE:CEPCO)

Despite strong share price growth of 37% for Concrete Engineering Products Berhad (KLSE:CEPCO) over the last few years, earnings growth has been disappointing, which suggests something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 12 January 2022. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for Concrete Engineering Products Berhad

Comparing Concrete Engineering Products Berhad's CEO Compensation With the industry

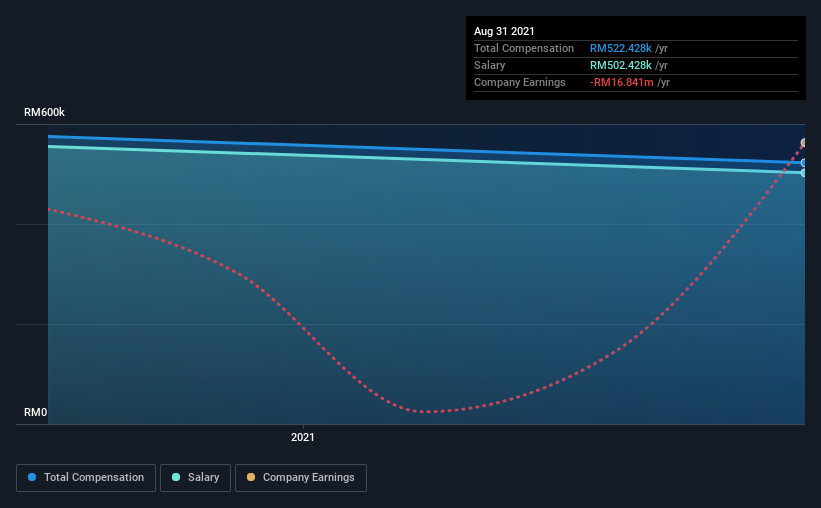

According to our data, Concrete Engineering Products Berhad has a market capitalization of RM71m, and paid its CEO total annual compensation worth RM522k over the year to August 2021. That's a notable decrease of 9.2% on last year. In particular, the salary of RM502.4k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under RM837m, the reported median total CEO compensation was RM189k. This suggests that Kway Wah Leong is paid more than the median for the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | RM502k | RM555k | 96% |

| Other | RM20k | RM20k | 4% |

| Total Compensation | RM522k | RM575k | 100% |

Talking in terms of the industry, salary represented approximately 82% of total compensation out of all the companies we analyzed, while other remuneration made up 18% of the pie. Concrete Engineering Products Berhad is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Concrete Engineering Products Berhad's Growth Numbers

Over the last three years, Concrete Engineering Products Berhad has shrunk its earnings per share by 39% per year. It achieved revenue growth of 5.5% over the last year.

The decline in EPS is a bit concerning. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Concrete Engineering Products Berhad Been A Good Investment?

We think that the total shareholder return of 37%, over three years, would leave most Concrete Engineering Products Berhad shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Concrete Engineering Products Berhad pays its CEO a majority of compensation through a salary. While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 2 warning signs (and 1 which is a bit unpleasant) in Concrete Engineering Products Berhad we think you should know about.

Switching gears from Concrete Engineering Products Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CEPCO

Concrete Engineering Products Berhad

Manufactures and distributes prestressed spun concrete piles and poles in Malaysia.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Rare Disease Monopoly" – Commercial Execution Play

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026