- Malaysia

- /

- Metals and Mining

- /

- KLSE:BSLCORP

Some Confidence Is Lacking In BSL Corporation Berhad (KLSE:BSLCORP) As Shares Slide 33%

The BSL Corporation Berhad (KLSE:BSLCORP) share price has fared very poorly over the last month, falling by a substantial 33%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 33% in that time.

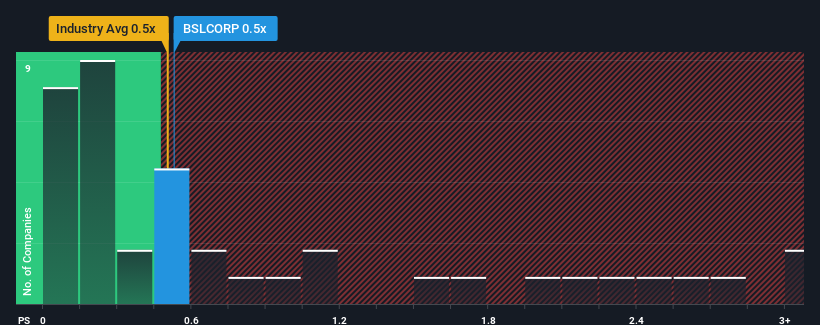

Although its price has dipped substantially, there still wouldn't be many who think BSL Corporation Berhad's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when it essentially matches the median P/S in Malaysia's Metals and Mining industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for BSL Corporation Berhad

How BSL Corporation Berhad Has Been Performing

For example, consider that BSL Corporation Berhad's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for BSL Corporation Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is BSL Corporation Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, BSL Corporation Berhad would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. This means it has also seen a slide in revenue over the longer-term as revenue is down 57% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 9.8% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that BSL Corporation Berhad is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From BSL Corporation Berhad's P/S?

With its share price dropping off a cliff, the P/S for BSL Corporation Berhad looks to be in line with the rest of the Metals and Mining industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at BSL Corporation Berhad revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Plus, you should also learn about these 3 warning signs we've spotted with BSL Corporation Berhad.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BSL Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BSLCORP

BSL Corporation Berhad

An investment holding company, engages in the stamping and manufacturing of precision metal parts, and fabrication of tools and dies in Malaysia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives