These 4 Measures Indicate That Batu Kawan Berhad (KLSE:BKAWAN) Is Using Debt Reasonably Well

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Batu Kawan Berhad (KLSE:BKAWAN) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Batu Kawan Berhad

How Much Debt Does Batu Kawan Berhad Carry?

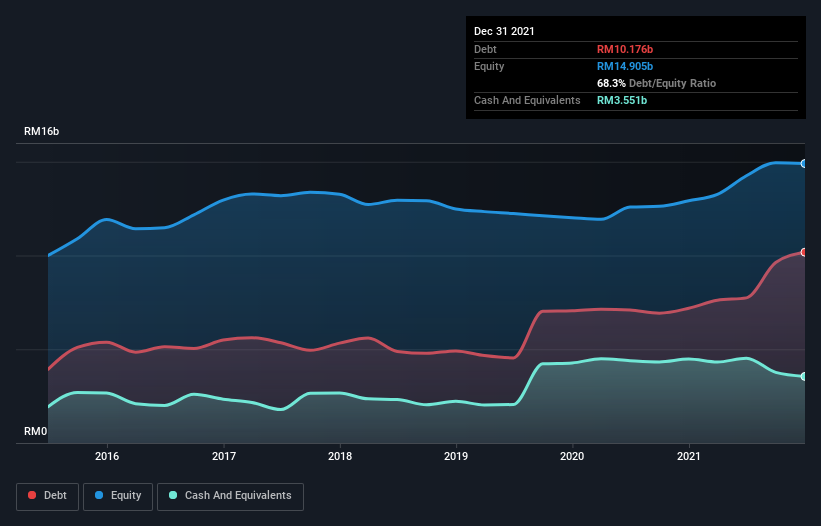

The image below, which you can click on for greater detail, shows that at December 2021 Batu Kawan Berhad had debt of RM10.2b, up from RM7.18b in one year. However, because it has a cash reserve of RM3.55b, its net debt is less, at about RM6.63b.

How Healthy Is Batu Kawan Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Batu Kawan Berhad had liabilities of RM7.51b due within 12 months and liabilities of RM8.11b due beyond that. Offsetting this, it had RM3.55b in cash and RM3.18b in receivables that were due within 12 months. So it has liabilities totalling RM8.89b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of RM11.2b, so it does suggest shareholders should keep an eye on Batu Kawan Berhad's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Batu Kawan Berhad's net debt to EBITDA ratio of about 1.5 suggests only moderate use of debt. And its strong interest cover of 12.7 times, makes us even more comfortable. Better yet, Batu Kawan Berhad grew its EBIT by 112% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. There's no doubt that we learn most about debt from the balance sheet. But it is Batu Kawan Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Batu Kawan Berhad recorded free cash flow of 33% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Batu Kawan Berhad's interest cover was a real positive on this analysis, as was its EBIT growth rate. Having said that, its level of total liabilities somewhat sensitizes us to potential future risks to the balance sheet. Considering this range of data points, we think Batu Kawan Berhad is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Batu Kawan Berhad (1 can't be ignored!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Batu Kawan Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BKAWAN

Batu Kawan Berhad

An investment holding company, cultivates and processes palm and rubber products in Malaysia, the Far East, the Middle East, South East Asia, Southern Asia, Europe, North and South America, Australia, Africa, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026