- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:WAVEFRNT

ATA IMS Berhad (KLSE:ATAIMS) Has A Pretty Healthy Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that ATA IMS Berhad (KLSE:ATAIMS) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for ATA IMS Berhad

What Is ATA IMS Berhad's Net Debt?

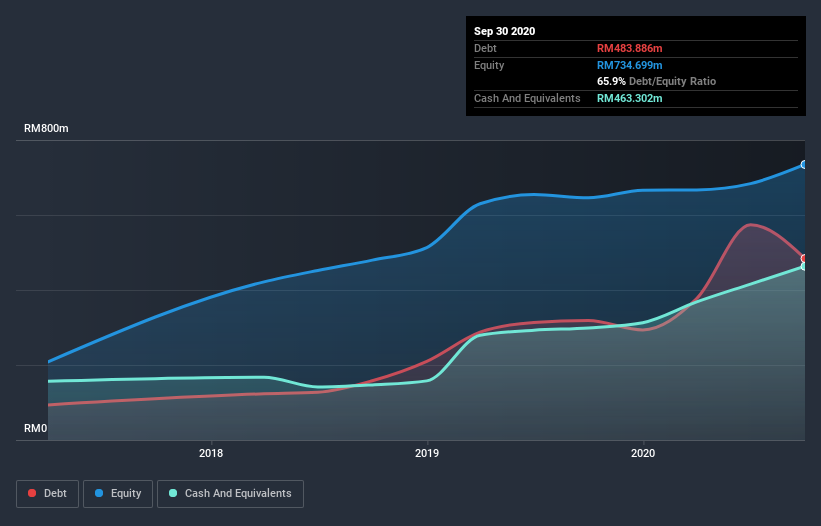

The image below, which you can click on for greater detail, shows that at September 2020 ATA IMS Berhad had debt of RM483.9m, up from RM318.5m in one year. However, it also had RM463.3m in cash, and so its net debt is RM20.6m.

A Look At ATA IMS Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that ATA IMS Berhad had liabilities of RM1.61b due within 12 months and liabilities of RM132.5m due beyond that. Offsetting these obligations, it had cash of RM463.3m as well as receivables valued at RM1.27b due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

This state of affairs indicates that ATA IMS Berhad's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the RM2.80b company is short on cash, but still worth keeping an eye on the balance sheet. Carrying virtually no net debt, ATA IMS Berhad has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

ATA IMS Berhad's net debt is only 0.12 times its EBITDA. And its EBIT covers its interest expense a whopping 13.4 times over. So we're pretty relaxed about its super-conservative use of debt. But the bad news is that ATA IMS Berhad has seen its EBIT plunge 17% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine ATA IMS Berhad's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Considering the last three years, ATA IMS Berhad actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Both ATA IMS Berhad's ability to to cover its interest expense with its EBIT and its net debt to EBITDA gave us comfort that it can handle its debt. In contrast, our confidence was undermined by its apparent struggle to grow its EBIT. Looking at all this data makes us feel a little cautious about ATA IMS Berhad's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with ATA IMS Berhad (including 1 which is is significant) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading ATA IMS Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WaveFront Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:WAVEFRNT

WaveFront Berhad

An investment holding company, provides electronics manufacturing services in Malaysia.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives