- Malaysia

- /

- Metals and Mining

- /

- KLSE:ANNJOO

Earnings Beat: Ann Joo Resources Berhad (KLSE:ANNJOO) Just Beat Analyst Forecasts, And Analysts Have Been Lifting Their Forecasts

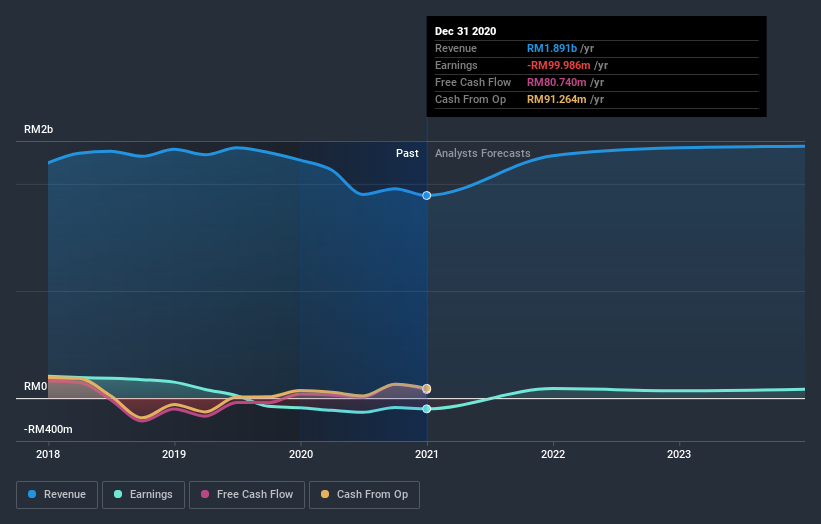

As you might know, Ann Joo Resources Berhad (KLSE:ANNJOO) just kicked off its latest yearly results with some very strong numbers. Ann Joo Resources Berhad beat expectations with revenues of RM1.9b arriving 6.1% ahead of forecasts. The company also reported a statutory loss of RM0.19, 2.7% smaller than was expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

View our latest analysis for Ann Joo Resources Berhad

Following the latest results, Ann Joo Resources Berhad's dual analysts are now forecasting revenues of RM2.26b in 2021. This would be a solid 20% improvement in sales compared to the last 12 months. Ann Joo Resources Berhad is also expected to turn profitable, with statutory earnings of RM0.14 per share. Yet prior to the latest earnings, the analysts had been forecasting revenues of RM2.11b and losses of RM0.013 per share in 2021. So we can see there's been a pretty clear upgrade to expectations following the latest results, with a modest lift to revenues expected to lead to profitability earlier than previously forecast.

With these upgrades, we're not surprised to see that the analysts have lifted their price target 122% to RM1.54per share.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that Ann Joo Resources Berhad's rate of growth is expected to accelerate meaningfully, with the forecast 20% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 3.4% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 12% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Ann Joo Resources Berhad to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts now expect Ann Joo Resources Berhad to become profitable next year, compared to previous expectations that it would report a loss. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Ann Joo Resources Berhad going out as far as 2023, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Ann Joo Resources Berhad (1 is potentially serious!) that you need to be mindful of.

When trading Ann Joo Resources Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ANNJOO

Ann Joo Resources Berhad

An investment holding company, manufactures and trades in iron, steel, and steel related products in Malaysia and Singapore.

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion