- Malaysia

- /

- Metals and Mining

- /

- KLSE:ALCOM

Alcom Group Berhad (KLSE:ALCOM) Has Announced A Dividend Of MYR0.025

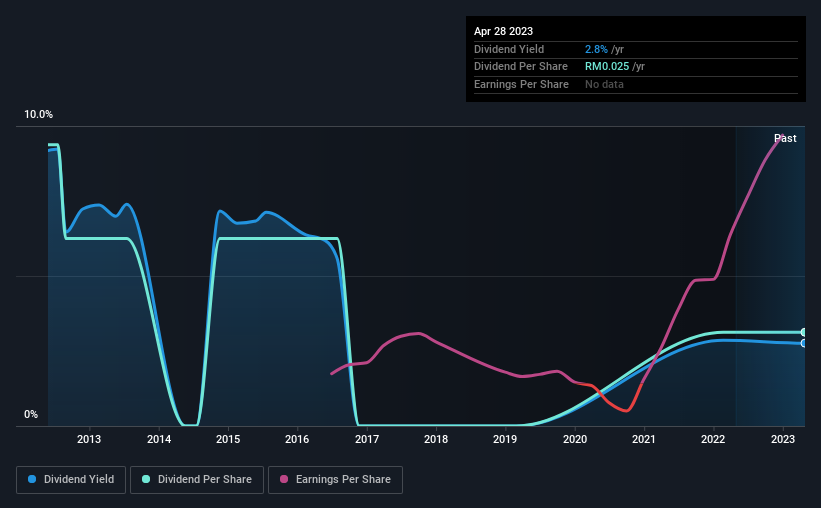

Alcom Group Berhad (KLSE:ALCOM) will pay a dividend of MYR0.025 on the 28th of July. Based on this payment, the dividend yield on the company's stock will be 2.8%, which is an attractive boost to shareholder returns.

View our latest analysis for Alcom Group Berhad

Alcom Group Berhad's Earnings Easily Cover The Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. However, prior to this announcement, Alcom Group Berhad's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS could expand by 43.1% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 3.2% by next year, which is in a pretty sustainable range.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2013, the annual payment back then was MYR0.075, compared to the most recent full-year payment of MYR0.025. Dividend payments have fallen sharply, down 67% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. We are encouraged to see that Alcom Group Berhad has grown earnings per share at 43% per year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

Alcom Group Berhad Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 2 warning signs for Alcom Group Berhad that investors should know about before committing capital to this stock. Is Alcom Group Berhad not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ALCOM

Alcom Group Berhad

An investment holding company, manufactures and trades aluminum sheet and coils products in Malaysia, the United States, Thailand, India, rest of Asia, Europe, the Middle East, and internationally.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026