David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Bioalpha Holdings Berhad (KLSE:BIOHLDG) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Bioalpha Holdings Berhad

How Much Debt Does Bioalpha Holdings Berhad Carry?

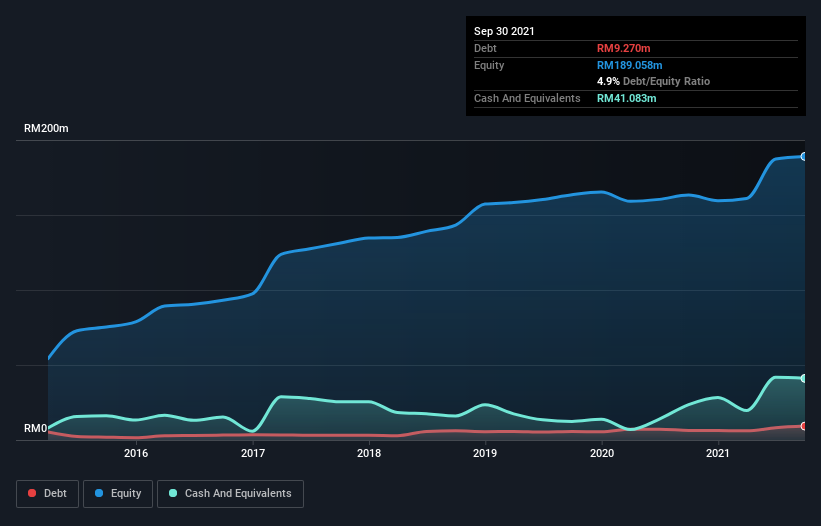

As you can see below, at the end of September 2021, Bioalpha Holdings Berhad had RM9.27m of debt, up from RM6.40m a year ago. Click the image for more detail. However, its balance sheet shows it holds RM41.1m in cash, so it actually has RM31.8m net cash.

How Healthy Is Bioalpha Holdings Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Bioalpha Holdings Berhad had liabilities of RM14.6m due within 12 months and liabilities of RM18.0m due beyond that. On the other hand, it had cash of RM41.1m and RM45.9m worth of receivables due within a year. So it can boast RM54.4m more liquid assets than total liabilities.

It's good to see that Bioalpha Holdings Berhad has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, Bioalpha Holdings Berhad boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Bioalpha Holdings Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Bioalpha Holdings Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 151%, to RM100m. So its pretty obvious shareholders are hoping for more growth!

So How Risky Is Bioalpha Holdings Berhad?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Bioalpha Holdings Berhad had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through RM23m of cash and made a loss of RM13m. Given it only has net cash of RM31.8m, the company may need to raise more capital if it doesn't reach break-even soon. Importantly, Bioalpha Holdings Berhad's revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Bioalpha Holdings Berhad (1 is a bit unpleasant) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Bioalpha Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BIOHLDG

Bioalpha Holdings Berhad

An investment holding company, manufactures and sells health supplement products in Malaysia, China, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026