Stock Analysis

- China

- /

- Medical Equipment

- /

- SHSE:688050

Top Glove Corporation Bhd Leads Trio Of Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As global markets exhibit mixed reactions to recent economic data, investors continue to navigate through a landscape marked by fluctuating inflation rates and shifting monetary policies. In such an environment, growth companies with high insider ownership can offer unique advantages, as these insiders often have a deep commitment to the company's long-term success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.8% | 58.7% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 36.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.8% | 97.7% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's explore several standout options from the results in the screener.

Top Glove Corporation Bhd (KLSE:TOPGLOV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Top Glove Corporation Bhd is a Malaysian-based company that specializes in the manufacturing, trading, and international sales of gloves, with a market capitalization of approximately MYR 9.69 billion.

Operations: The company's revenue primarily stems from the gloves manufacturing industry, generating MYR 2.16 billion.

Insider Ownership: 29.9%

Earnings Growth Forecast: 116.8% p.a.

Top Glove Corporation Bhd, a company with significant insider buying in the past three months, is poised for notable growth. Its revenue is expected to grow at 35.1% annually, outpacing the Malaysian market's 6.3% growth rate. Despite a highly volatile share price recently, Top Glove trades slightly below its estimated fair value and anticipates becoming profitable within three years—a forecast well above average market expectations. Recent board changes include new appointments enhancing governance structures as part of its strategic adjustments to foster this growth trajectory.

- Navigate through the intricacies of Top Glove Corporation Bhd with our comprehensive analyst estimates report here.

- Our valuation report here indicates Top Glove Corporation Bhd may be overvalued.

Eyebright Medical Technology (Beijing) (SHSE:688050)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. is a company that operates in the healthcare sector, with a market capitalization of approximately CN¥12.45 billion.

Operations: The company generates revenue primarily from its medical products segment, amounting to CN¥1.07 billion.

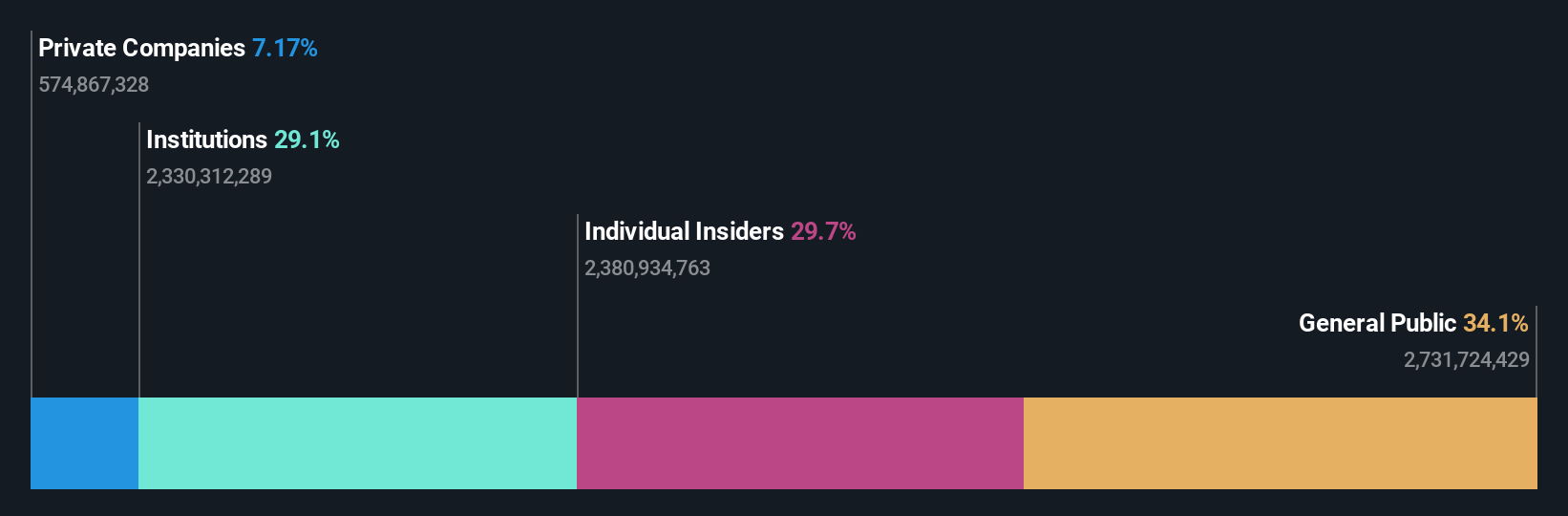

Insider Ownership: 21.5%

Earnings Growth Forecast: 27.2% p.a.

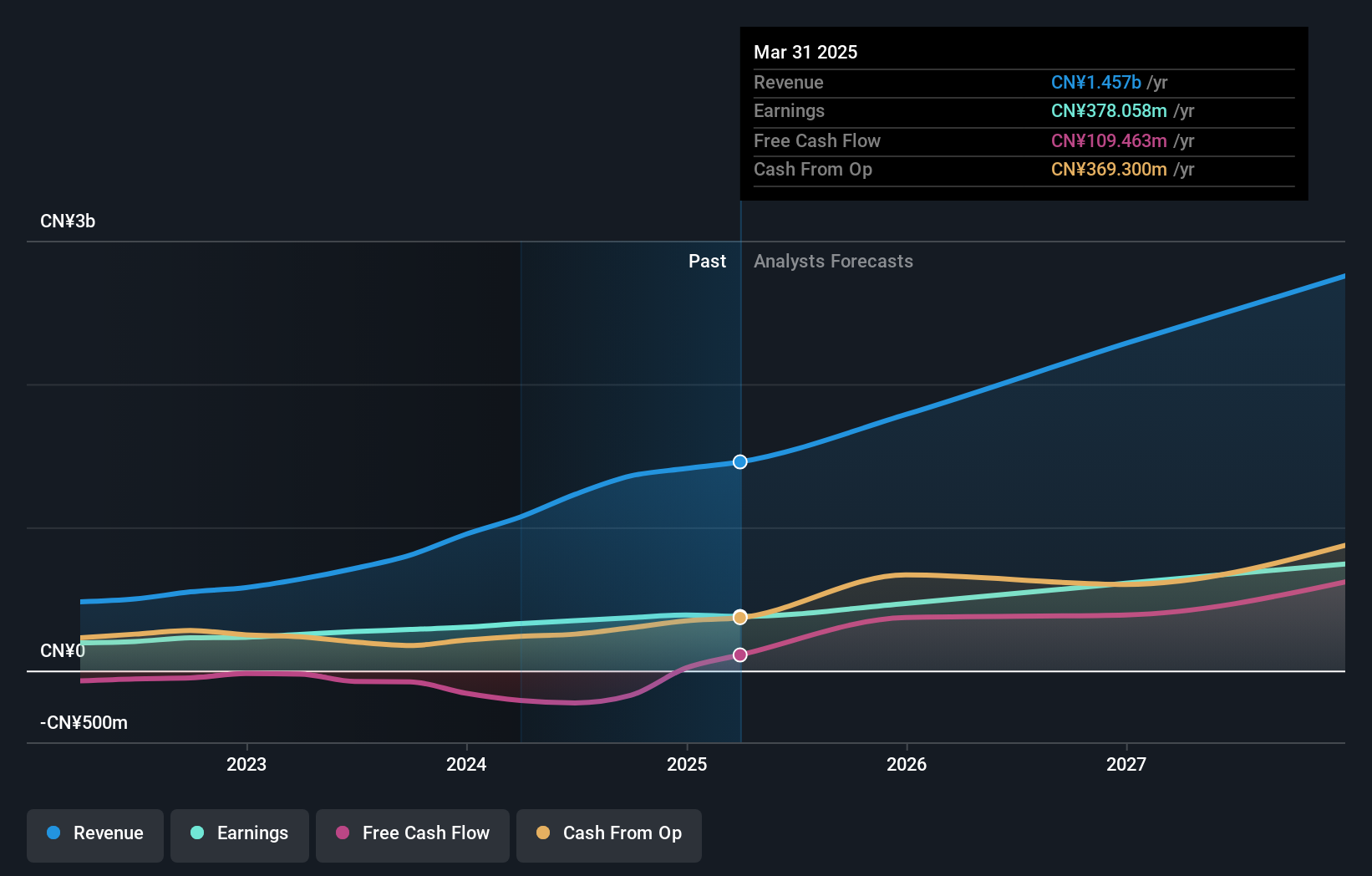

Eyebright Medical Technology (Beijing) demonstrates robust growth potential with its earnings expected to increase significantly, forecasted at 27.2% per year, outperforming the Chinese market's 22.2%. Despite trading 43.4% below its estimated fair value, suggesting a good investment opportunity, concerns arise from its low forecasted Return on Equity of 17.7%. Recent financials show substantial year-over-year gains with revenue rising to CNY 310.4 million and net income up to CNY 102.9 million, reflecting strong operational performance.

- Unlock comprehensive insights into our analysis of Eyebright Medical Technology (Beijing) stock in this growth report.

- Our expertly prepared valuation report Eyebright Medical Technology (Beijing) implies its share price may be lower than expected.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★★☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. is a technology service provider specializing in end-to-end solutions for various industries, with a market capitalization of approximately CN¥32.59 billion.

Operations: The company's revenue is primarily generated from Communication Equipment (CN¥7.05 billion), followed by Financial Technology (CN¥4.04 billion), Internet Service (CN¥3.29 billion), and High Technology and Manufacturing (CN¥2.37 billion).

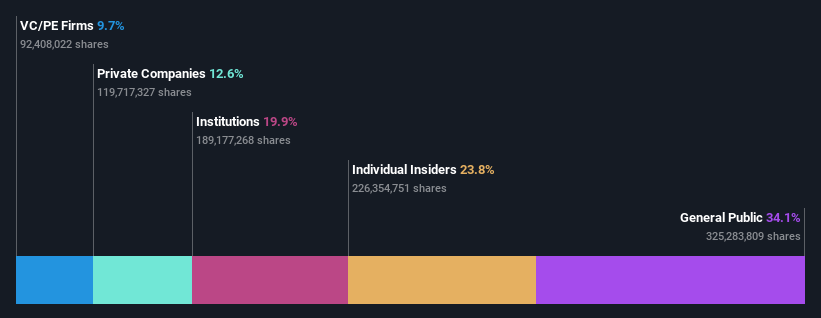

Insider Ownership: 23.8%

Earnings Growth Forecast: 30.7% p.a.

iSoftStone Information Technology (Group) is poised for notable growth with earnings forecasted to increase by 30.7% annually, surpassing the Chinese market's average of 22.2%. Despite a robust revenue growth outlook of 24% per year, the company's profit margins have declined from last year's 5.1% to this year’s 3%. Additionally, recent corporate activities include significant amendments in governance and dividend distributions, reflecting active management engagement and potential strategic shifts aimed at enhancing long-term value.

- Take a closer look at iSoftStone Information Technology (Group)'s potential here in our earnings growth report.

- Our valuation report unveils the possibility iSoftStone Information Technology (Group)'s shares may be trading at a premium.

Next Steps

- Click through to start exploring the rest of the 1433 Fast Growing Companies With High Insider Ownership now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Eyebright Medical Technology (Beijing) is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688050

Eyebright Medical Technology (Beijing)

Eyebright Medical Technology (Beijing) Co., Ltd.

High growth potential with excellent balance sheet.