Stock Analysis

- China

- /

- Communications

- /

- SZSE:300627

3 High Insider Ownership Growth Companies On Chinese Exchange With Up To 27% Revenue Growth

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets, Chinese stocks have shown resilience, buoyed by strong export figures and anticipations surrounding upcoming economic policies. In this context, exploring growth companies with high insider ownership on Chinese exchanges could offer intriguing insights, especially given the current economic climate where informed leadership could be pivotal in navigating market uncertainties.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.4% | 28.4% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 25.8% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Smartsens Technology (Shanghai) (SHSE:688213)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smartsens Technology (Shanghai) Co., Ltd. is a company specializing in the development and manufacturing of advanced sensor technologies, with a market capitalization of CN¥22.67 billion.

Operations: The company generates CN¥3.24 billion in revenue from its semiconductor integrated circuit chips segment.

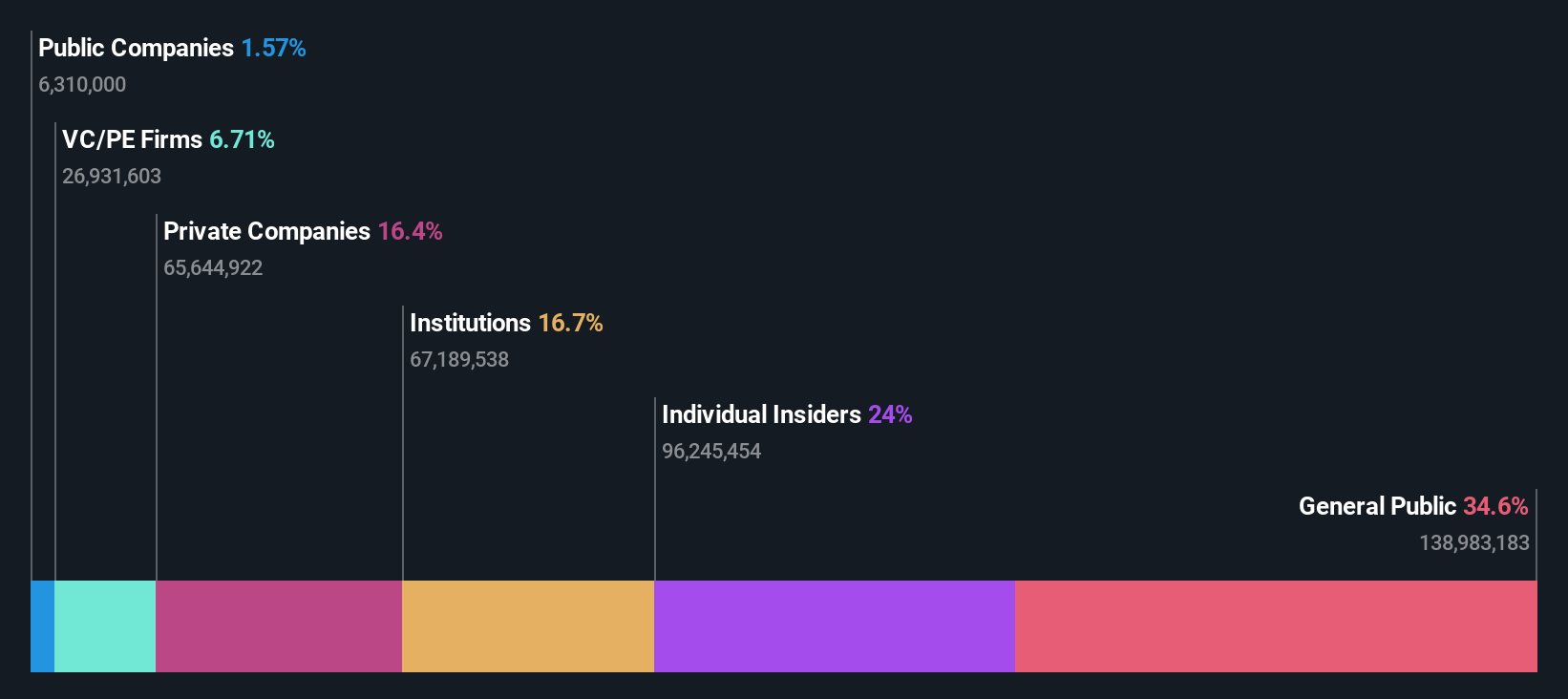

Insider Ownership: 24.4%

Revenue Growth Forecast: 26% p.a.

Smartsens Technology (Shanghai) has demonstrated a robust turnaround in its financial performance, transitioning from a net loss to posting a net income of CNY 14.03 million as per the latest quarterly earnings. With revenue more than doubling to CNY 837.4 million, the company's growth trajectory surpasses the broader Chinese market's average. Despite this rapid expansion, forecasted earnings growth is very large at 60.94% annually over the next three years, significantly outpacing market expectations. However, it's important to note that quality of earnings may be affected by substantial one-off items and its Return on Equity is expected to remain low at 12.5%.

- Get an in-depth perspective on Smartsens Technology (Shanghai)'s performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Smartsens Technology (Shanghai) shares in the market.

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Huace Navigation Technology Ltd. specializes in the development and manufacturing of geospatial data processing equipment, with a market capitalization of approximately CN¥17.47 billion.

Operations: The company generates revenue primarily through the development and manufacturing of geospatial data processing equipment.

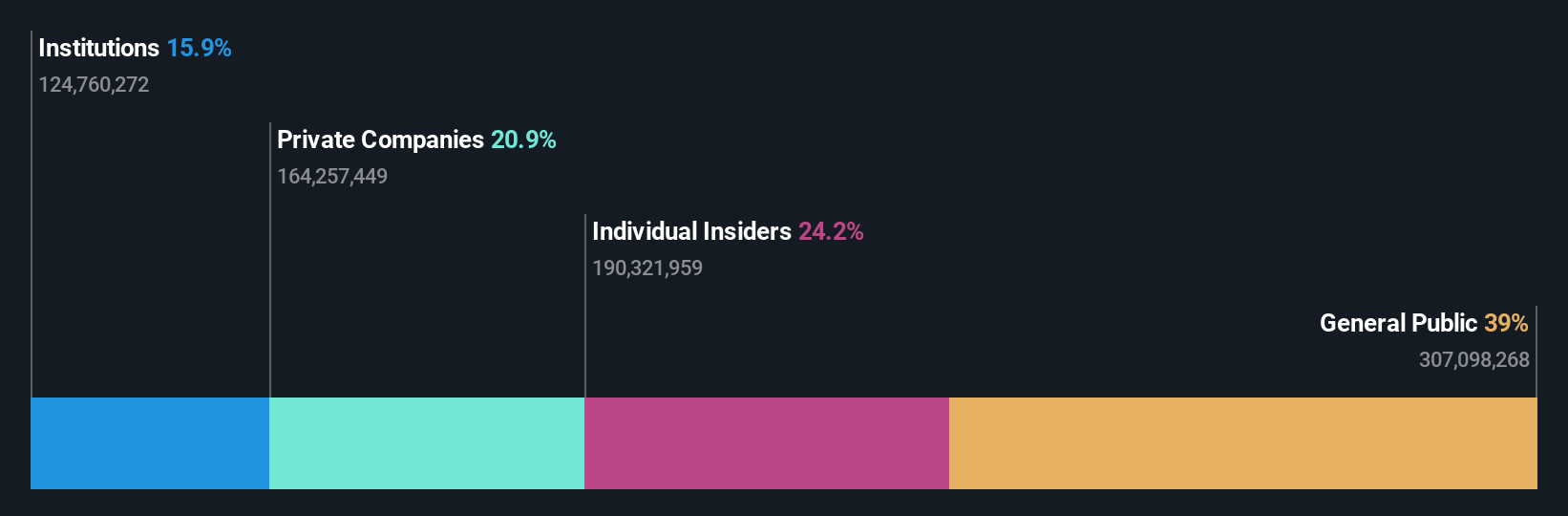

Insider Ownership: 26.6%

Revenue Growth Forecast: 23.5% p.a.

Shanghai Huace Navigation Technology is experiencing substantial growth, with earnings projected to increase by 23.18% annually. This performance is complemented by a recent 23.5% revenue growth year-over-year, outpacing the broader Chinese market's average significantly. Despite these strong figures, the company's Return on Equity is expected to remain modest at 19.1%. Recent corporate actions include dividend increases and significant amendments to its bylaws and business scope, reflecting active management engagement and strategic adjustments.

- Unlock comprehensive insights into our analysis of Shanghai Huace Navigation Technology stock in this growth report.

- Our valuation report unveils the possibility Shanghai Huace Navigation Technology's shares may be trading at a premium.

Sinofibers TechnologyLtd (SZSE:300777)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sinofibers Technology Co., Ltd. specializes in the research and development, production, and sales of high-performance carbon fibers and fabrics, with a market capitalization of approximately CN¥9.20 billion.

Operations: The company generates CN¥500.45 million from its New Material Manufacturing Industry segment.

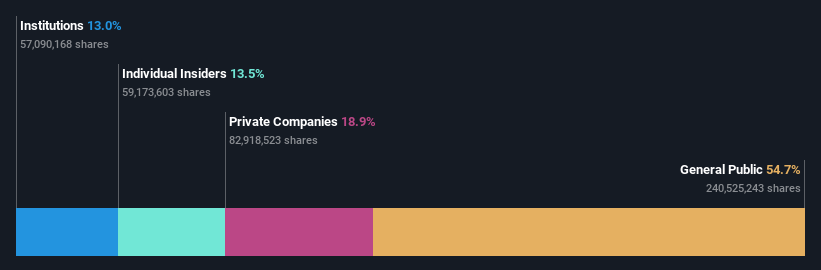

Insider Ownership: 13.5%

Revenue Growth Forecast: 27.1% p.a.

Sinofibers Technology Ltd., a Chinese growth company with high insider ownership, has recently seen a decrease in dividends but has initiated a share repurchase program valued at CNY 30 million, signaling strong insider confidence. Despite a decline in quarterly revenue and net income year-over-year, the company is expected to achieve robust earnings growth of 27.82% annually. Analysts project the stock price could rise significantly, although current returns on equity are anticipated to remain low.

- Click here to discover the nuances of Sinofibers TechnologyLtd with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Sinofibers TechnologyLtd's share price might be too pessimistic.

Key Takeaways

- Discover the full array of 366 Fast Growing Chinese Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Shanghai Huace Navigation Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300627

Shanghai Huace Navigation Technology

Shanghai Huace Navigation Technology Ltd.

Flawless balance sheet with high growth potential.