- China

- /

- Paper and Forestry Products

- /

- SHSE:600963

Take Care Before Diving Into The Deep End On Yueyang Forest & Paper Co., Ltd. (SHSE:600963)

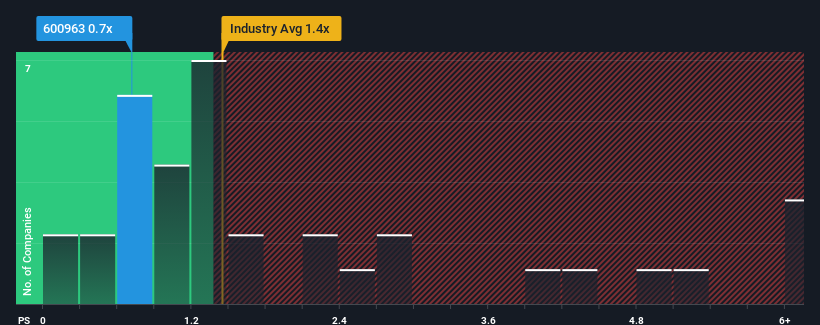

When you see that almost half of the companies in the Forestry industry in China have price-to-sales ratios (or "P/S") above 1.4x, Yueyang Forest & Paper Co., Ltd. (SHSE:600963) looks to be giving off some buy signals with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Yueyang Forest & Paper

What Does Yueyang Forest & Paper's Recent Performance Look Like?

Yueyang Forest & Paper hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Yueyang Forest & Paper's future stacks up against the industry? In that case, our free report is a great place to start.How Is Yueyang Forest & Paper's Revenue Growth Trending?

In order to justify its P/S ratio, Yueyang Forest & Paper would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 14%, which is not materially different.

In light of this, it's peculiar that Yueyang Forest & Paper's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Yueyang Forest & Paper's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Yueyang Forest & Paper currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Having said that, be aware Yueyang Forest & Paper is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Yueyang Forest & Paper, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600963

Yueyang Forest & Paper

Manufactures and sells cultural, industrial, and packaging paper products in China and internationally.

Moderate risk second-rate dividend payer.

Market Insights

Community Narratives