- Malaysia

- /

- Healthcare Services

- /

- KLSE:HONGSENG

We Ran A Stock Scan For Earnings Growth And Hong Seng Consolidated Berhad (KLSE:HONGSENG) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hong Seng Consolidated Berhad (KLSE:HONGSENG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hong Seng Consolidated Berhad with the means to add long-term value to shareholders.

View our latest analysis for Hong Seng Consolidated Berhad

How Fast Is Hong Seng Consolidated Berhad Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Hong Seng Consolidated Berhad grew its EPS from RM0.0026 to RM0.023, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

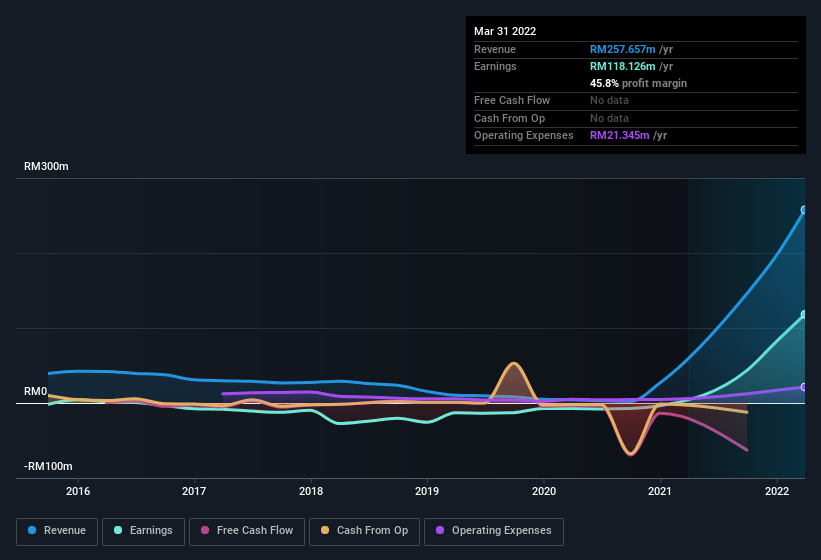

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Hong Seng Consolidated Berhad is growing revenues, and EBIT margins improved by 26.3 percentage points to 42%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Hong Seng Consolidated Berhad's balance sheet strength, before getting too excited.

Are Hong Seng Consolidated Berhad Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Hong Seng Consolidated Berhad followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. We note that their impressive stake in the company is worth RM591m. This totals to 20% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Does Hong Seng Consolidated Berhad Deserve A Spot On Your Watchlist?

Hong Seng Consolidated Berhad's earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. Based on the sum of its parts, we definitely think its worth watching Hong Seng Consolidated Berhad very closely. We should say that we've discovered 3 warning signs for Hong Seng Consolidated Berhad that you should be aware of before investing here.

Although Hong Seng Consolidated Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hong Seng Consolidated Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HONGSENG

Hong Seng Consolidated Berhad

An investment holding company, engages in gloves and NBL manufacturing, healthcare, and financial services in Malaysia and Australia.

Good value with adequate balance sheet.

Market Insights

Community Narratives