Is Now The Time To Put QL Resources Berhad (KLSE:QL) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in QL Resources Berhad (KLSE:QL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for QL Resources Berhad

How Fast Is QL Resources Berhad Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that QL Resources Berhad has managed to grow EPS by 20% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

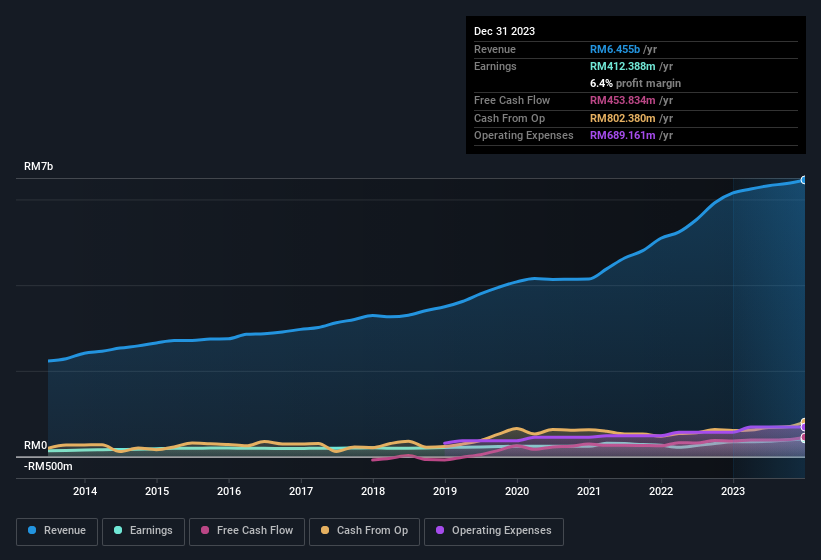

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that QL Resources Berhad is growing revenues, and EBIT margins improved by 2.1 percentage points to 10%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for QL Resources Berhad?

Are QL Resources Berhad Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that QL Resources Berhad insiders have a significant amount of capital invested in the stock. We note that their impressive stake in the company is worth RM538m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like QL Resources Berhad with market caps between RM9.5b and RM30b is about RM4.1m.

The QL Resources Berhad CEO received total compensation of only RM108k in the year to March 2023. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does QL Resources Berhad Deserve A Spot On Your Watchlist?

For growth investors, QL Resources Berhad's raw rate of earnings growth is a beacon in the night. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. Everyone has their own preferences when it comes to investing but it definitely makes QL Resources Berhad look rather interesting indeed. Of course, just because QL Resources Berhad is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Malaysian companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if QL Resources Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:QL

QL Resources Berhad

An investment holding, operates as an agro-food company in Malaysia, Indonesia, Vietnam, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026