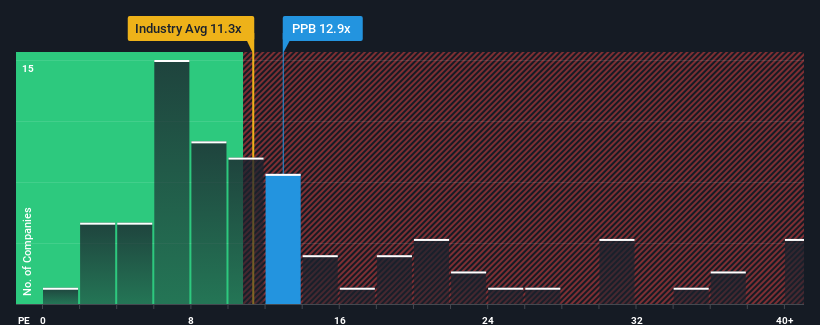

There wouldn't be many who think PPB Group Berhad's (KLSE:PPB) price-to-earnings (or "P/E") ratio of 12.9x is worth a mention when the median P/E in Malaysia is similar at about 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, PPB Group Berhad's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for PPB Group Berhad

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like PPB Group Berhad's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 19% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 9.5% per year over the next three years. That's shaping up to be similar to the 9.6% per annum growth forecast for the broader market.

With this information, we can see why PPB Group Berhad is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From PPB Group Berhad's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of PPB Group Berhad's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 1 warning sign for PPB Group Berhad that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PPB

PPB Group Berhad

An investment holding company, engages in the grains and agribusiness worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives