We Think Shareholders Are Less Likely To Approve A Large Pay Rise For NPC Resources Berhad's (KLSE:NPC) CEO For Now

Key Insights

- NPC Resources Berhad to hold its Annual General Meeting on 10th of June

- Salary of RM846.0k is part of CEO Pang Loo's total remuneration

- The overall pay is 164% above the industry average

- Over the past three years, NPC Resources Berhad's EPS grew by 44% and over the past three years, the total shareholder return was 2.6%

Under the guidance of CEO Pang Loo, NPC Resources Berhad (KLSE:NPC) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 10th of June. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for NPC Resources Berhad

Comparing NPC Resources Berhad's CEO Compensation With The Industry

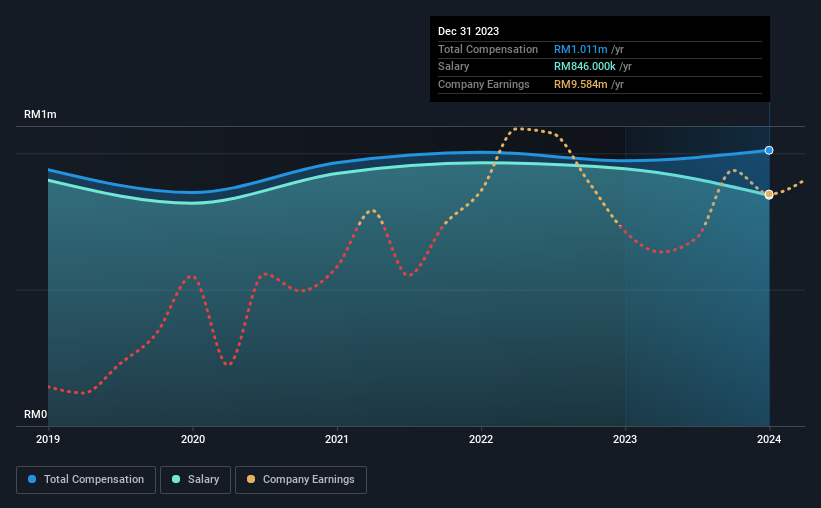

According to our data, NPC Resources Berhad has a market capitalization of RM228m, and paid its CEO total annual compensation worth RM1.0m over the year to December 2023. That's a modest increase of 3.9% on the prior year. Notably, the salary which is RM846.0k, represents most of the total compensation being paid.

For comparison, other companies in the Malaysian Food industry with market capitalizations below RM941m, reported a median total CEO compensation of RM383k. Hence, we can conclude that Pang Loo is remunerated higher than the industry median. What's more, Pang Loo holds RM42m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM846k | RM943k | 84% |

| Other | RM165k | RM30k | 16% |

| Total Compensation | RM1.0m | RM973k | 100% |

Talking in terms of the industry, salary represented approximately 66% of total compensation out of all the companies we analyzed, while other remuneration made up 34% of the pie. According to our research, NPC Resources Berhad has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

NPC Resources Berhad's Growth

NPC Resources Berhad's earnings per share (EPS) grew 44% per year over the last three years. Its revenue is up 6.2% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has NPC Resources Berhad Been A Good Investment?

NPC Resources Berhad has not done too badly by shareholders, with a total return of 2.6%, over three years. It would be nice to see that metric improve in the future. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for NPC Resources Berhad (of which 2 are significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if NPC Resources Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NPC

NPC Resources Berhad

An investment holding company, engages in oil palm plantation and milling activities in Malaysia and Indonesia.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives